Originally Posted, 26 Feb 2024 – Carbon Capture: the missing link for decarbonising the world

Key Takeaways

- Close to 300 million tonnes of CO2 has already been safely and successfully injected underground.

- The number of CCS projects being proposed or under development is expected to reach over 300 million tonnes per annum by 2030, up from around 45.9 million tonnes in 20221.

- The CCS market, estimated at $3.28 billion in 2022, is projected to grow at a compound annual growth rate of 7.1% to 20302.

- Carbon capture and storage is a vital aid in helping develop a circular economy.

- Related Products WisdomTree Recycling Decarbonisation UCITS ETF – USD Acc Find out more

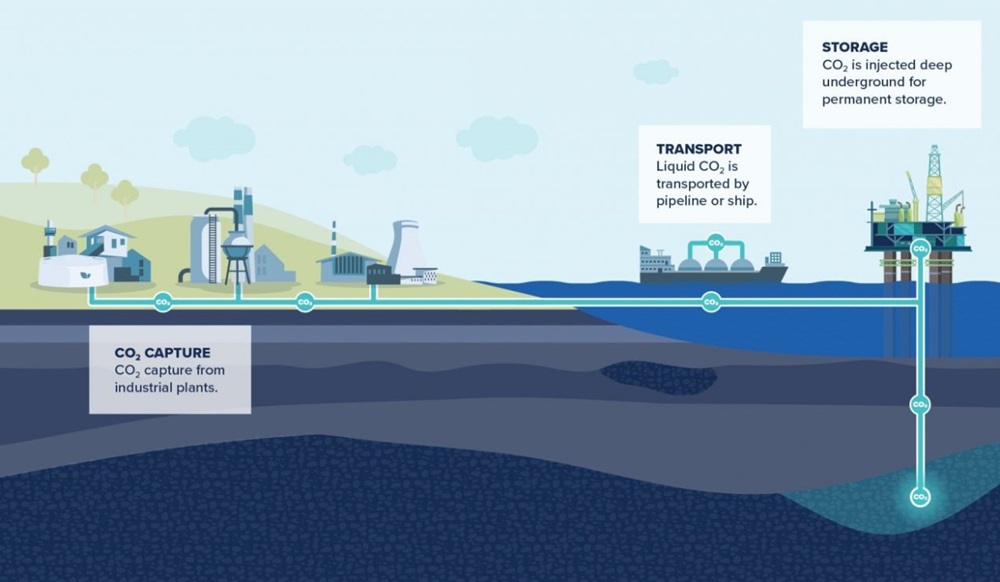

Carbon Capture and Storage (CCS) refers to the process of capturing carbon dioxide (CO2) emissions and storing them safely so that they do not harm the environment. This term encapsulates technologies that capture emissions at the source as well as those that capture CO2 from the atmosphere.

Source: Global CCS Institute, 2024.

According to the CCS Institute, CCS is already happening around the world using a wide range of technologies to capture emissions, depending on their source. The Institute states that there are currently 29 facilities, with a cumulative capacity of around 40 million tonnes per annum – the equivalent of taking nearly eight million cars off the road. Close to 300 million tonnes of CO2 has already been safely and successfully injected underground.

WisdomTree Recycling Decarbonisation UCITS ETF (WRCY)

The WisdomTree Recycling Decarbonisation UCITS ETF (WRCY), built in partnership with experts TortoiseEcofin, is founded on two key pillars. The first pillar is waste to energy, which is the process of generating energy from waste such as household waste, animal manure, agriculture products and/or animal fats. This theme includes companies engaged in the production of renewable fuels, such as sustainable jet fuel, as well as ethanol and other biomass, like wood pellets. The second pillar is recycling. These companies are engaged in recycling business activities including traditional recycling activities like plastic recycling, where plastic is recycled into original materials such as polypropylene for re-use, and lithium-ion battery recycling, as well as companies engaged in carbon capture and sequestration.

WRCY is classified as SFDR Article 93.

The tailwinds for adoption

Firstly, heavy industries that are difficult to decarbonise are embracing carbon capture. Cement manufacturing is one such example. Heidelberg Cement, a global cement manufacturer, is developing eight carbon capture initiatives around the world. Steel manufacturer, ArcelorMittal, has also integrated carbon capture within its multi-billion-dollar investment program. The production of blue hydrogen (made from natural gas and emissions subjected to CCS) also benefits from the technology. Aramco, the world’s largest oil company, is employing this tool to produce sustainable hydrogen4.

Secondly, policy support is also helping with CCS adoption. The Inflation Reduction Act includes tax credits of $85/tonne for CCS projects that reduce emissions from fossil fuels5. In Europe, European Union Allowances (EUAs), which put a price on the emissions of entities regulated within the Emissions Trading Scheme (ETS), are meant to incentivise the adoption of clean technologies. The higher the price of emitting CO2, the more companies will be incentivised to turn towards solutions like renewable energy and CCS.

We know that no single solution can help us fully decarbonise the world. Renewable energy, electrification, recycling, etc must all play a role – and so must carbon capture. Fortunately, the adoption of this technology is on the rise. The number of CCS projects being proposed or under development is expected to reach over 300 million tonnes per annum by 2030, up from around 45.9 million tonnes in 20226. The CCS market, estimated at $3.28 billion in 2022, is projected to grow at a compound annual growth rate of 7.1% to 20307.

Companies at the forefront

As the space develops, business models are also evolving. Aker has established itself as a leading player in the industry offering a carbon capture service as a one-stop solution. Instead of businesses incurring large capital expenditure to reduce or eliminate their emissions, they can employ Aker and pay per tonne of CO2 captured, letting Aker take care of the full value chain of CCS, from capture through to transportation and storage.

NET Power is another player in the industry, which produces energy by combusting natural gas and either injecting the CO2 back into the process for energy generation or capturing and storing it safely. The company claims that its technology captures over 97% of CO2 emissions from power generation.

LanzaTech presents yet another business model while still operating in the same industry. The company takes it a step further by transforming the captured carbon into something valuable and useful at scale. This helps reduce the need for fossil carbon in consumer goods and sustainable aviation fuels.

The circular economy

Carbon capture and storage is a vital aid in helping develop a circular economy. Our traditional model of utilising natural resources has historically been linear: take, make, and dispose. A circular model, in contrast, is one in which we take, make, and recycle. And when recycling is not possible, a circular model aims to minimise the detrimental impact on the environment, like storing carbon safely underground.

Sources

1 International Energy Agency, sourced from World Economic Forum, October 2023.

2 Grand View Research, 2023.

3 Sustainable Finance Disclosure Regulation

4 World Economic Forum, October 2022.

5 US Inflation Reduction Act, reported by the FT November 2023.

6 International Energy Agency, sourced from World Economic Forum, October 2023.

7 Grand View Research, 2023.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.