Originally posted, 30 January 2024 – Cboe Europe Derivatives 2023 Recap and Look Ahead

As we start a new year, we wanted to recap some of our key achievements in 2023 and provide an update on what to expect from us in 2024 to help support your European derivatives trading needs.

Some of our 2023 highlights, which we explore further below, include:

- Successfully expanding into pan-European single stock options from November;

- Securing commitment from Interactive Brokers, one of the world’s largest retail brokers, to join CEDX and provide its clients with access to the exchange’s index derivatives and single stock products;

- A series of volume records in our index derivatives, including a record monthly ADV in December and record quarterly volume in Q4;

- The introduction of a new Volume Incentive Programme for our index futures;

- Re-enforcing the eligibility of CEDX index futures to qualified US investors.

2023 Volumes and Participation

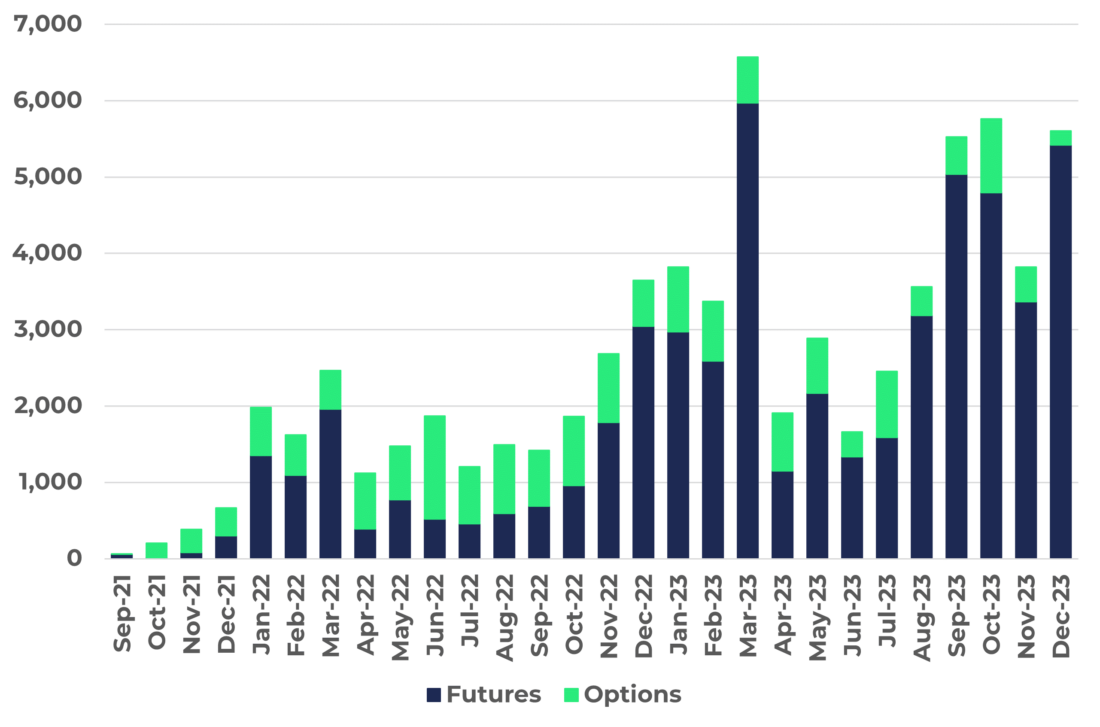

The last year was a busy and exciting one as we continued our journey to creating a modern, vibrant pan-European equity derivatives marketplace that brings greater efficiencies to participants and grows the European market overall. Total CEDX volumes were 46,970 lots compared with 22,857 in 2022. March was an all-time record month with 6,574 contracts traded, beating the previous record of 3,824 contracts set in January (see chart 1).

Chart 1 – CEDX’s Total Volumes Since Launch

Past performance is not indicative of future results

Source: CEDX data

CEDX ended the year particularly strongly, with a record monthly ADV in December of 295 lots across our futures and options products. We also enjoyed record quarterly volumes of 15,195 in Q4, up 85% on Q4 2022. In terms of specific contracts, the largest volume since launch continues to be in the Cboe Eurozone 50 index options contract (EZ50O), followed closely by the Cboe Eurozone 50 index future (EZ50F). You can view our December 2023 infographic here for further information on volume breakdowns.

The introduction of a new Volume Incentive Programme in August for our index futures has helped to boost activity, and this was recently extended to at least 31 March 2024.

Given market developments, we spent a lot of time highlighting to clients that all CEDX index futures products are based on indices from our benchmark administrator Cboe Europe Indices, where daily checks are performed that help to ensure that CEDX index futures adhere to CFTC rules on broad-based indices. This enables qualified US investors to access CEDX futures, providing they do so via brokers.

From a participant perspective, we continued to expand our client base in 2023 and are seeing interest from a range of new firms, including retail brokers, institutions and regional firms who are excited by CEDX’s proposition.

Product Highlights

The highlight from a product perspective – and our major focus in the early part of 2024 – was the successful expansion into pan-European single stock options in November. Our strategy is to grow volumes in European options by building a pan-European ecosystem – in terms of trading, clearing, and market data – that simplifies access to and dramatically reduces costs for those wishing to access this market. We are also promoting a US-style on-screen market to attract participants accustomed to this type of market in the US.

Furthermore, single stock options traded on CEDX will be cleared by Cboe Clear Europe, the largest pan-European clearing house. As well as offering margin offsets between index and single stock products, Cboe Clear will permit the use of underlying stocks as collateral to provide offsets against matched equity option positions, delivering a potential initial margin reduction for a covered call position of around 70%, according to initial estimates. Stock settlement (on options exercise and assignment) will take place in domestic Central Securities Depositories (CSDs), removing unnecessary costs and allowing for settlement netting with relevant cash equities transactions.

We will have a wider universe of products available by the end of Q1 2024 and, in line with client readiness, will start our liquidity provision programmes at the end of the March 2024 expiry. You can trade CEDX’s single stock options for free during all of 2024.

We announced that the firms that have committed to supporting our expansion into single stock options include existing participants ABN AMRO Clearing, All Options, Barak Market Making B.V, Goldman Sachs, Morgan Stanley and Susquehanna International Securities. We are also excited that Interactive Brokers committed to connecting to CEDX for the first time, which is a strong endorsement of our strategy to grow volumes in European through the creation of a simpler, lower cost, more efficient pan-European marketplace.

Daily-Expiring Options

I will leave the final word on the hot topic of daily-expiring options. We have been closely monitoring the successful adoption of these products on Cboe’s US options exchanges and recent developments in Europe. CEDX’s product development is driven by client demand primarily, but weekly and daily-expiring contracts are under consideration for 2024 on a select group of underlyings for our index derivatives. Please stay tuned for further information.

Disclaimer: This information is not being provided as part of an offer or sale of any futures or options products to any persons located within the United States.

Disclosure: Cboe Global Markets

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, or at www.theocc.com. The information in this program is provided solely for general education and information purposes. No statement within the program should be construed as a recommendation to buy or sell a security or to provide investment advice. The opinions expressed in this program are solely the opinions of the participants, and do not necessarily reflect the opinions of Cboe or any of its subsidiaries or affiliates. You agree that under no circumstances will Cboe or its affiliates, or their respective directors, officers, trading permit holders, employees, and agents, be liable for any loss or damage caused by your reliance on information obtained from the program.

Copyright © 2023 Chicago Board Options Exchange, Incorporated. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Cboe Global Markets and is being posted with its permission. The views expressed in this material are solely those of the author and/or Cboe Global Markets and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.