Originally posted – 20 March 2024 – Is it time to trade your cash for short-dated fixed income? The shift could be a multi-decade opportunity for savvy investors.

By Karen Wright and Michael Lake

In this piece, we delve into the world of bonds with shorter maturities and their potential to offer a stable, less volatile alternative to cash.

When we discuss short-dated fixed income, we’re referring to bonds with shorter maturities, typically up to around three or five years. Due to their lower sensitivity to interest rate fluctuations, these bonds tend to be less volatile than their long-dated counterparts, making them an attractive option for investors contemplating a move away from cash. But that’s not the only reason to consider them now.

1. Short-dated bonds offer attractive valuations

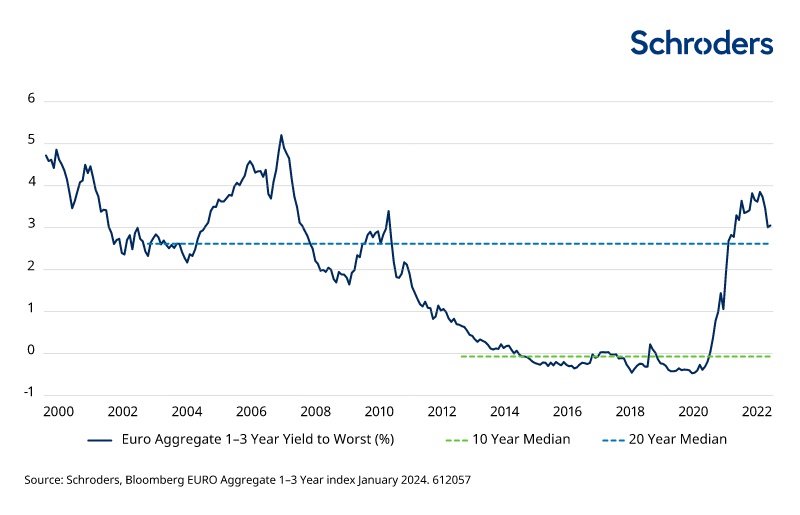

The past few years have been challenging for bond investors, with high volatility keeping investors up at night and rapidly rising interest rates causing prices to tumble. But this has also created a unique opportunity. Fixed income investors can now benefit from significantly higher yields. The Bloomberg Euro Aggregate 1–3 Year Index, for example, now boasts yields above both the 10-year and 20-year medians.

CHART1: Valuations

Note: Based on annual returns since its inception, the Bloomberg Euro Aggregate 1–3-year index has outperformed cash on 20 occasions. Cash has outperformed in only 4 of those years. – Past performance is not indicative of future results

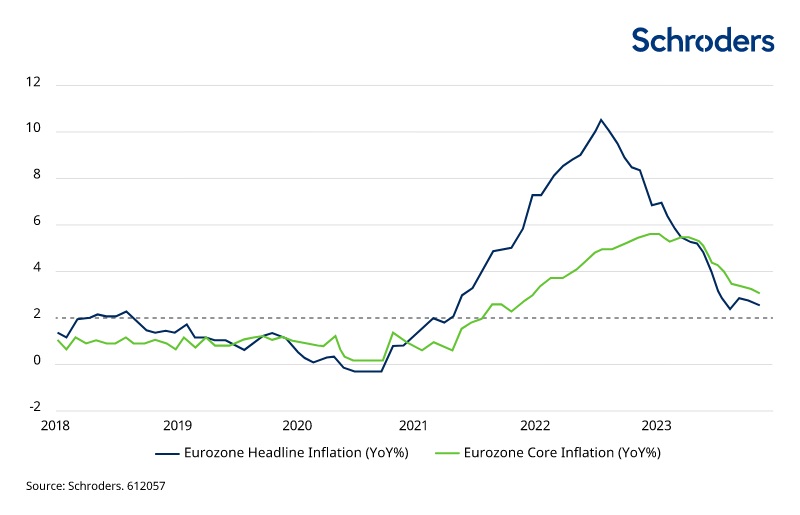

2. The economic backdrop is supportive

Falling yields (yields move inversely to price) could provide an additional ‘kicker’ to bond returns. Our Global Unconstrained Fixed Income team’s base case is a ‘soft landing’, where central banks successfully curb inflation without damaging the economy. This environment should benefit both government and corporate bonds as interest rates fall and businesses are generally proving resilient.

Expectations are high for the European Central Bank (ECB) and other central banks to start cutting rates in the coming months as inflation pressures ease. A reduction in interest rates typically leads to an increase in bond prices, with increased demand for existing bonds with higher fixed coupons leading to an increase in prices. Lower interest rates also support business conditions, with lower borrowing costs making it easier for companies to pay coupons to bondholders.

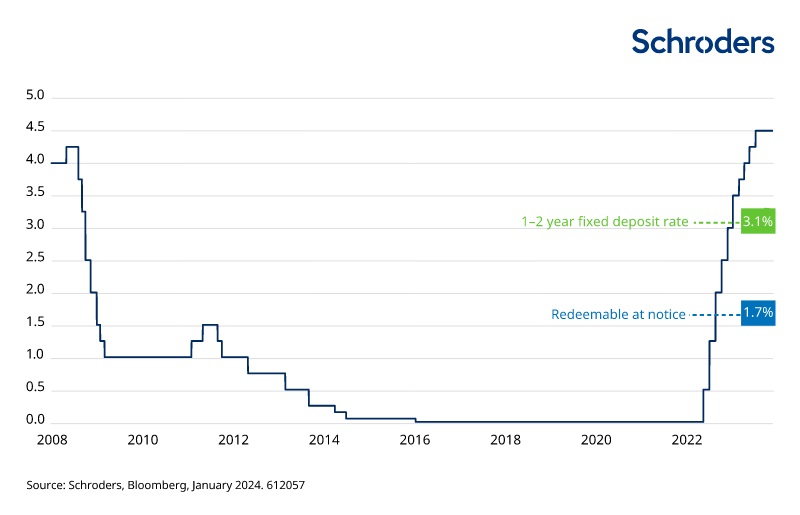

CHART2: The progress on European inflation has been relatively good

Past performance is not indicative of future results

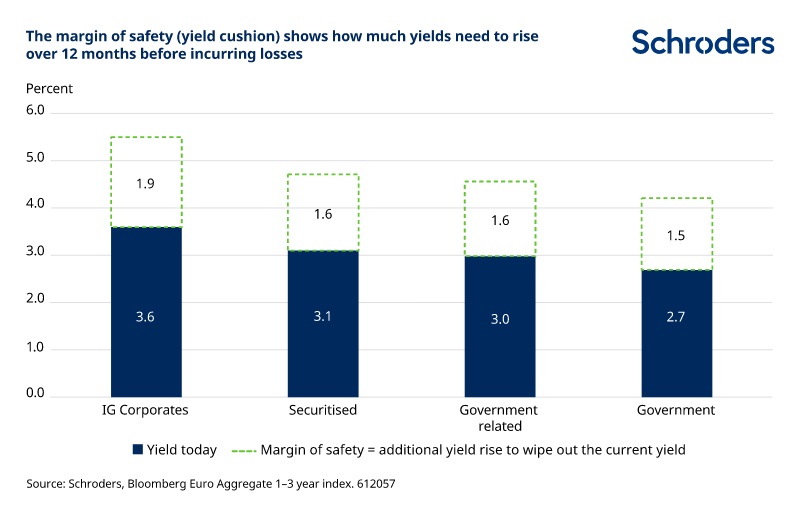

3. The protective yield cushion – putting the ‘income’ back into fixed income

Higher yields in short-dated fixed income now provide the best safety margin against capital losses in years. This “yield cushion” is the protective effect that this income can have on a bond investment. If bond prices fall (which would result in a capital loss if the bond were sold), the income generated by the bond can offset some or all of this loss. In other words, the yield provides a “cushion” against declines in the bond’s price.

The yield cushion is particularly important for investors concerned about capital losses.

This chart is based on the Bloomberg Euro Aggregate Index 1-3 year.

CHART3: The yield cushion is providing the highest margin of safety against capital losses for many years

Note, the margin of safety (or yield cushion) is how much yields need to rise over 12 months before incurring actual losses. – Past performance is not indicative of future results

4. Cash rates may lose their appeal

With deposit rates closely linked to monetary policy, the attractive interest rates on deposits enjoyed over the past year may not last. In fact, actual deposit rates are often already lower than those inferred by central banks. According to ECB data, the average deposit rate (redeemable at notice) is just 1.7%. By investing in short-dated fixed income, investors can lock in higher yields, as demonstrated in the chart above, for a longer period.

CHART4: The yield you get on short dated fixed income is higher than most deposit rates.

Past performance is not indicative of future results

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.