The years before the 2008 financial crisis were brilliant for Deutsche Bank, although like many other financial institutions around the world, its future changed completely within a few months. Their situation was not as dire as Lehman Brothers, but DBK had their fair share of difficulties. The price plummeted from about 90 EUR to 10 EUR over the course of one year; that loss represented almost 90% of its value.

Source: ibkr.ie Past performance is not indicative of future results.

In the years since, the stock has fought to regain some of its lost value, but the hits seem to keep on coming and its stormy days do not seem to have passed completely.

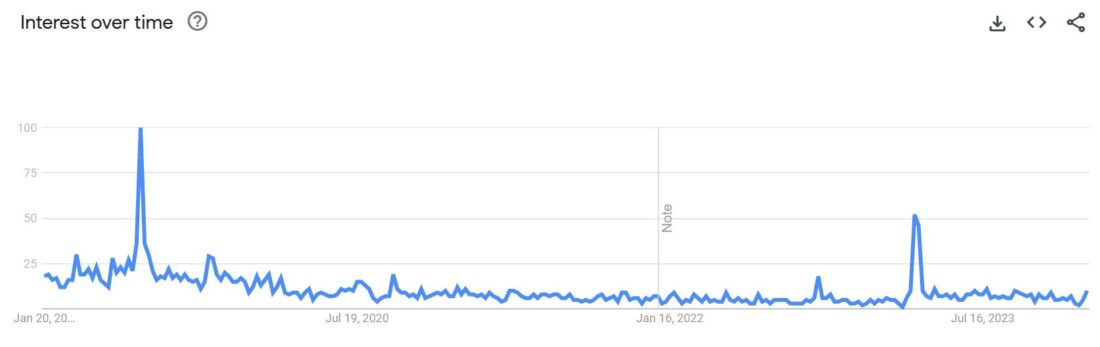

One interesting statistic can be seen in Google Trends when filtering the periods in which the public has searched Deutsche Bank news on Google (See chart below).

Deutsche Bank news Google Trends

Source: Google Trends

In this chart above, we can see how, excluding the month at the beginning of the first coronavirus panic (presumably, everyone was worried about banks in general at this time), the period in which most people went to Google searching for news about DBK was during March 2023, when several banks went into bankruptcy in the United States and Credit Suisse was force-rescued by UBS with a little help from the Swiss government.

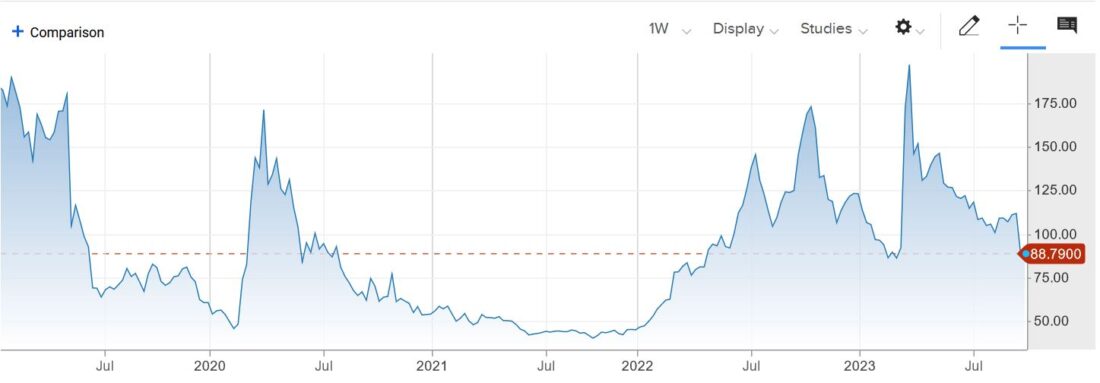

Deutsche Bank Credit Default Swaps 5-Yr Chart

Source: CBNC Past performance is not indicative of future results

If we look at the chart of the evolution of Credit Default Swaps (CDS) over the last 5 years, we easily see the relationship between news searches on Google and the premium paid by the market for protection against Deutsche Bank. At that time, for some investors its bankruptcy seemed imminent and fear was reflected in the price of the CDS, since then the reality was very different as we can see in the chart below from 1 year ago.

Source: ibkr.ie Past performance is not indicative of future results.

Since then, the stock has risen almost 40% so far, similar to other Europeans banks. Higher interest rates have helped banks to improve their balance sheets and revenues with mortgages and loans offered at higher interest rates and therefore become more profitable and improve their overall liquidity situation.

Even though it is far from reaching the level of its best years before the financial crisis, when we look at the value of both the evolution of its stock and the CDS, it seems that the moment of greatest tension has passed.

Is it a good time for DBK? Opinions are varied. Whether it is an opportunity or not depends on each investor’s outlook.

52-week high EUR 12.818 / 52-week low EUR 7.945

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.