Originally Posted, 22 April 2024 – Inflation, macroeconomy and stock market sentiment: A tale of 2023

This insight series with Probability & Partners delves into contemporary observations and insights, covering topics such as media sentiment in financial markets, advancements in generative AI, and more.

- This first insight focuses on news sentiment surrounding major stock market indices.

- We explore how news sentiment has evolved over 2023 in response to macroeconomic and monetary policy events, particularly in the UK, EU, and US markets.

- By considering quantitative news characteristics such as relevance, novelty, and sentiment, our indicators provide insights into sentiment trends. Aggregating these signals across asset universes allows us to gauge sentiment about major stock markets like the FTSE 100, S&P 500, STOXX 600, NASDAQ 100, and others.

We’ve often witnessed the unique value of company sentiment monitoring in both risk reduction and return enhancement within investment strategies. During the onset of the COVID crisis we observed a consistent and sharp decline in sentiment across all major stock markets, weeks before COVID-19 became a prominent topic. The stock markets eventually experienced a dramatic downturn, and the preceding decline in sentiment served as a valuable and timely warning indicator, occurring up to four weeks in advance.

The strength of sentiment lies in its ability to signal such significant downturns effectively. However, stock market sentiment also reflects various other events, including inflation and monetary policy announcements, growth forecasts, geopolitical tensions, and any other pertinent information influencing stock market performance. An examination of regional market sentiment and stock market performance in 2023 reveals very different stories for the UK, Europe and US.

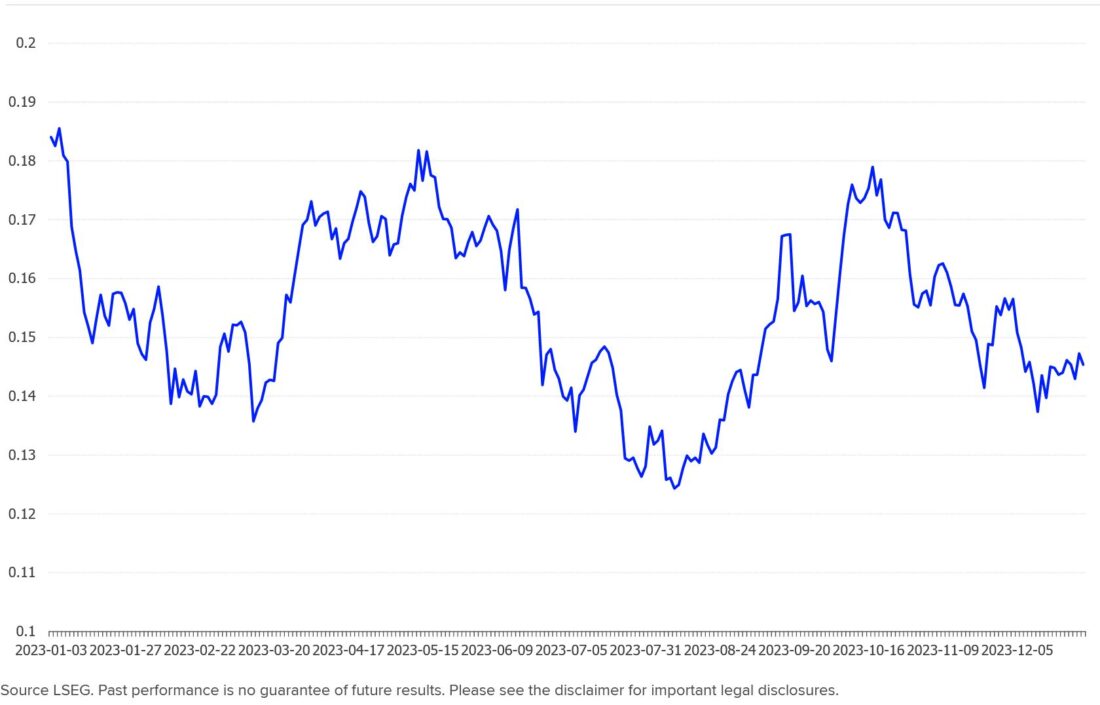

Sentiment vs. FTSE 100

In particular 2023 was rich in such events, with inflation, interest rates, and growth concerns dominating both the economy and the media landscape. Despite this backdrop, sentiment surrounding the UK stock market (FTSE 100) generally remained positive. However, significant sentiment swings were observed throughout the year, particularly in June and September 2023. In June 2023 a cascade of adverse economic news struck the UK: reports of high inflation which exceeded predictions, and sluggish growth featured in the media. Despite an inflation expectation of 5%, the actual figure soared to 8.7%. Additionally, Q1 results indicated a slow start for the UK economy, raising concerns about the risk of recession. While mainstream news acknowledged these issues at the end of June, we observed a decline in related stock market sentiment two weeks prior. Specifically, June 19 and 26 witnessed the largest sentiment drops, although the downward trend commenced on June 15: from around that time, a trickle of gloomy news regarding high inflation, elevated gilt yields, long-term stagnation, and an increased number of bankruptcies emerged. Overall, it seems that the inability to curb, and accurately forecast inflation significantly impacted stock market sentiment.

On September 15, the UK stock market sentiment experienced its largest daily increase of the year, prompted by the announcement of a larger-than-expected inflation slowdown. This positive momentum was however short-lived, as September 20 saw the biggest sentiment drop of the year. This decline followed the reduction of growth forecasts to just 0.1%, accompanied by fears of the UK slipping into recession by the end of 2023 (these fears materialised, as the UK indeed confirmed its recessionary status by the end of the year).

FTSE Sentiment

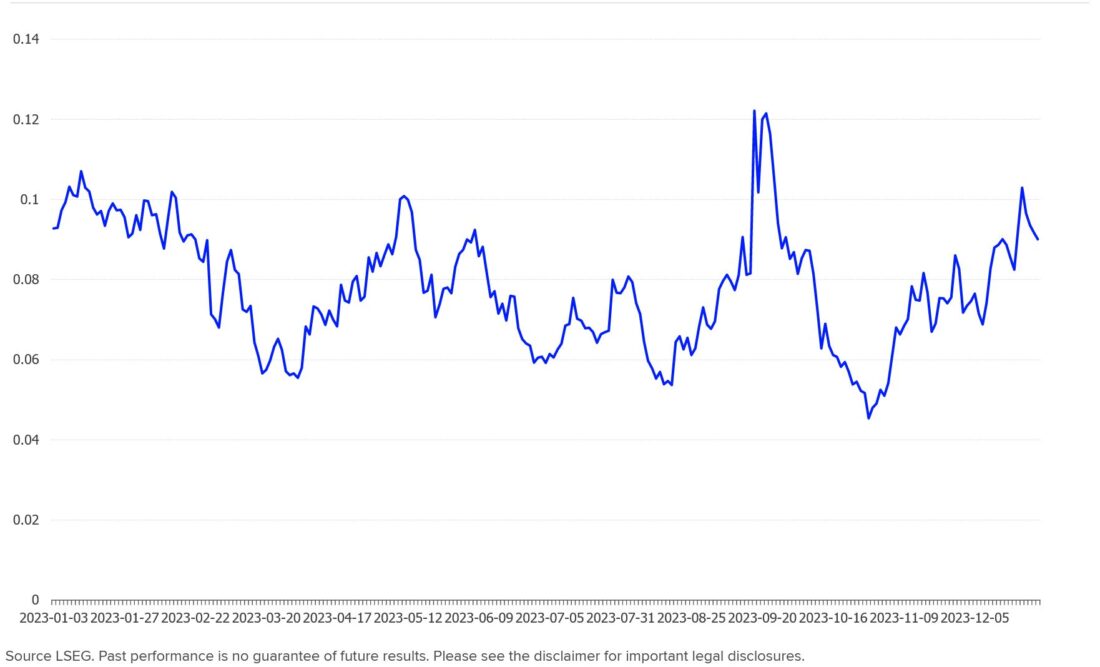

Sentiment vs. STOXX 600

In contrast to the UK, the sentiment surrounding the EU stock market (STOXX 600) in 2023 appeared notably less positive, largely influenced by the significant contraction of the EU economy stemming from the Russia-Ukraine conflict, which dominated both economic and media sentiment. Once again, September witnessed the most pronounced sentiment volatility, characterised by substantial swings ranging from -20% to +50% in a single day. Such drastic fluctuations typically signify a lack of consensus within the media regarding the state and trajectory of the stock market. The EU exemplifies this, as sentiment appeared to vary significantly among member states, with Southern countries like Spain exhibiting generally positive sentiment while Northern European countries struggled. Economic news in September for the EU was predominantly pessimistic, featuring negative outlooks, stagnant growth, and downward revisions of economic forecasts. These developments were duly reflected in the sharp decline and volatile sentiment of the EU stock market (which was partially alleviated a little later by the release of better-than-expected results).

Stoxx Sentiment

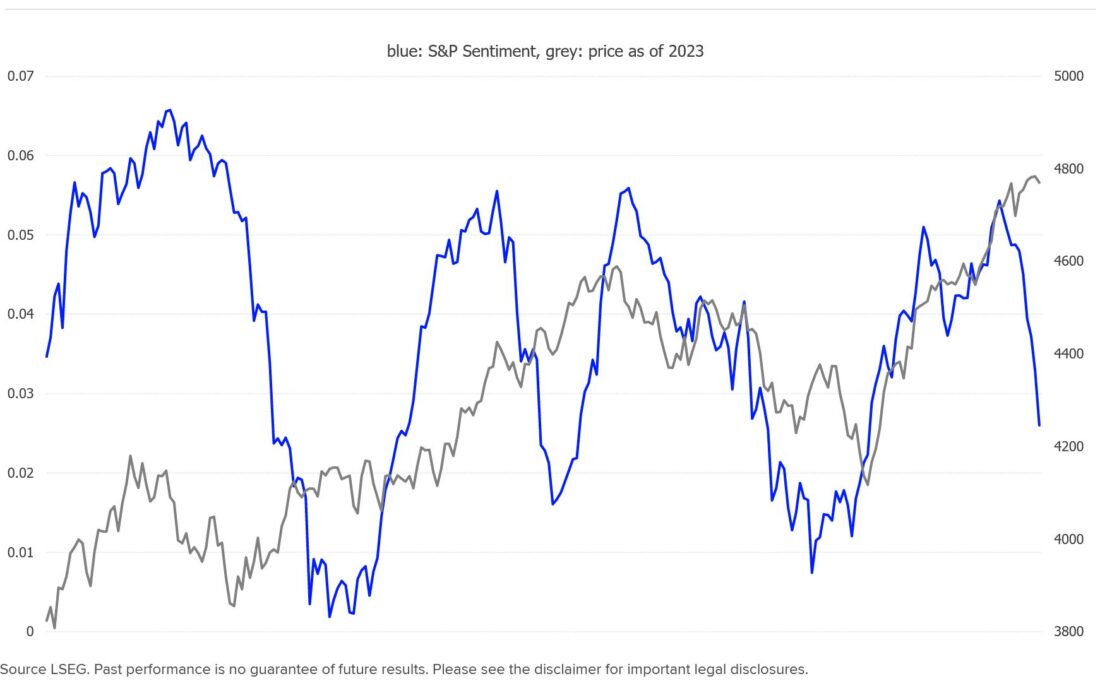

Sentiment vs. S&P 500

The analysis of US stock market (S&P 500) sentiment provides fascinating insights. The most notable sentiment downturn occurred in the immediate aftermath of the US banking turmoil in March 2023, triggered by the failures of Silicon Valley Bank and Signature Banks. Interestingly, this decline did not manifest in the S&P 500 itself, as it was largely confined to the financial sector. A similar dip was observed in EU stock market sentiment at the end of March, following turbulence surrounding Credit Suisse. Subsequently, US stock market sentiment improved around June, coinciding with Fed rate hikes and the debt ceiling agreement. However, concerns over US inflation (reaching a reported peak of 9%), similar to those in the UK, dominated (and suppressed) stock market sentiment in late June to July.

October witnessed another dip in sentiment, presumably following the onset of the Israel-Palestine conflict, an event not mirrored in either UK or EU sentiment. This was followed by a decline in the S&P 500 index a few weeks later, as we often observe. Towards the end of October, interest rates reached a peak, accompanied by the arrival of positive macroeconomic indicators. This initially lifted stock market sentiment, subsequently boosting the index itself. This positive trend continued towards the year’s end, with media reports highlighting strong demand numbers and robust GDP forecasts. However, sentiment took a downturn towards the very end of 2023 due to speculations of a possible US recession. Despite this decline in sentiment, the S&P closed the year up 9%, indicating an uncommon occurrence where the sentiment decline did not correlate with a similar decline in the index itself. This anomaly warrants further investigation to understand the underlying dynamics at play.

S&P Sentiment and price trend

This piece only scratches the surface of the many intriguing sentiment-related observations that emerged throughout 2023, stay tuned for the next Insight.

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2024 London Stock Exchange Group. All rights reserved.

The content of this publication is provided by London Stock Exchange Group plc, its applicable group undertakings and/or its affiliates or licensors (the “LSE Group” or “We”) exclusively.

Neither We nor our affiliates guarantee the accuracy of or endorse the views or opinions given by any third party content provider, advertiser, sponsor or other user. We may link to, reference, or promote websites, applications and/or services from third parties. You agree that We are not responsible for, and do not control such non-LSE Group websites, applications or services.

The content of this publication is for informational purposes only. All information and data contained in this publication is obtained by LSE Group from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data are provided “as is” without warranty of any kind. You understand and agree that this publication does not, and does not seek to, constitute advice of any nature. You may not rely upon the content of this document under any circumstances and should seek your own independent legal, tax or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the publication and its content is at your sole risk.

To the fullest extent permitted by applicable law, LSE Group, expressly disclaims any representation or warranties, express or implied, including, without limitation, any representations or warranties of performance, merchantability, fitness for a particular purpose, accuracy, completeness, reliability and non-infringement. LSE Group, its subsidiaries, its affiliates and their respective shareholders, directors, officers employees, agents, advertisers, content providers and licensors (collectively referred to as the “LSE Group Parties”) disclaim all responsibility for any loss, liability or damage of any kind resulting from or related to access, use or the unavailability of the publication (or any part of it); and none of the LSE Group Parties will be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, howsoever arising, even if any member of the LSE Group Parties are advised in advance of the possibility of such damages or could have foreseen any such damages arising or resulting from the use of, or inability to use, the information contained in the publication. For the avoidance of doubt, the LSE Group Parties shall have no liability for any losses, claims, demands, actions, proceedings, damages, costs or expenses arising out of, or in any way connected with, the information contained in this document.

LSE Group is the owner of various intellectual property rights (“IPR”), including but not limited to, numerous trademarks that are used to identify, advertise, and promote LSE Group products, services and activities. Nothing contained herein should be construed as granting any licence or right to use any of the trademarks or any other LSE Group IPR for any purpose whatsoever without the written permission or applicable licence terms.

Disclosure: London Stock Exchange

This publication does not constitute an offer to buy or sell, or a solicitation of an offer to sell, any securities, or the solicitation of a proxy, by any person in any jurisdiction in which such an offer or solicitation is not authorised, or in which the person making such an offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such an offer or solicitation. London Stock Exchange has taken reasonable efforts to ensure that the information contained in this publication is correct at the time of going to press, but shall not be liable for decisions made in reliance on it. Therefore, please note that this publication may be updated at any time. The information contained in this publication and any other publications referred herein are for guidance purposes only. London Stock Exchange and the coat of arms device are registered trade marks of London Stock Exchange plc.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from London Stock Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or London Stock Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.