Originally Posted, 1 May 2024 – Is Yen Weakness Tied to Japan’s High Debt Levels?

Since the Bank of Japan (BoJ) lifted rates out of negative territory on March 18, the yen (JPY) has continued to sell off, hitting 160 versus the US dollar (USD) in intraday trading on April 29 before a widely suspected intervention by the Bank of Japan (BoJ) saw the yen rebound, at least temporarily.

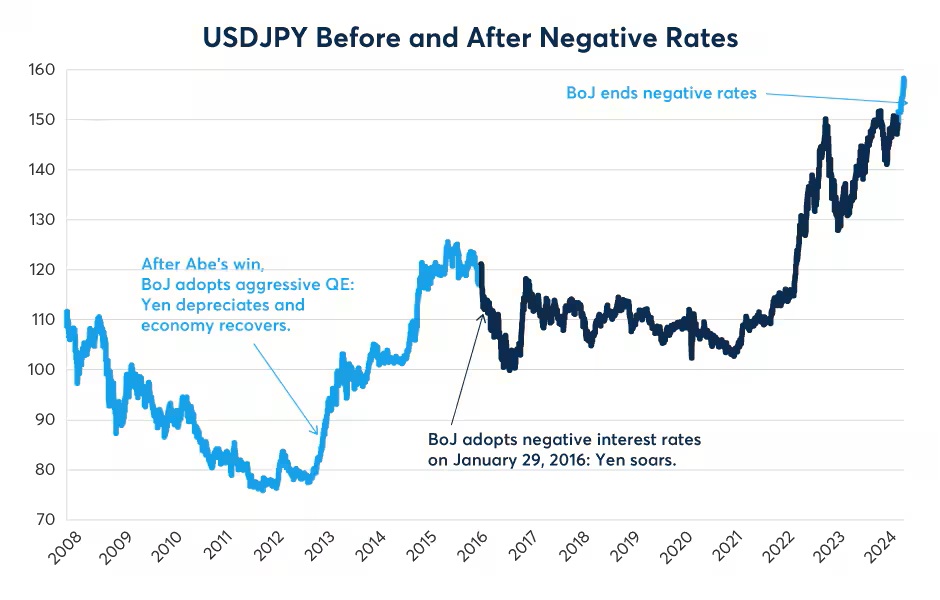

Our previous paper on the yen highlighted the idea that negative rates, while meant to ease monetary policy and boost growth, actually have the opposite effect. Serving as a tax on the banking system, negative rates lead to unintended policy tightening (Figure 1). The fact that the yen soared versus USD in the months after the BoJ initiated negative rates in January 2016 supports this hypothesis.

Figure 1: Negative rates might have unintentionally tightened monetary policy & supported the yen

Source: Bloomberg Professional (BOJBPBAL and JPY) – Past performance is not indicative of future results

The yen’s recent continued sell-off versus USD confirms our proposition that getting out of negative rates are an unintentional easing of monetary policy. Lifting the policy rate from -10 basis points (bps) to a range from 0 to +10 bps appears to be easing monetary policy, sending the yen lower versus USD and other currencies as the Federal Reserve’s (Fed) monetary policy remains tight.

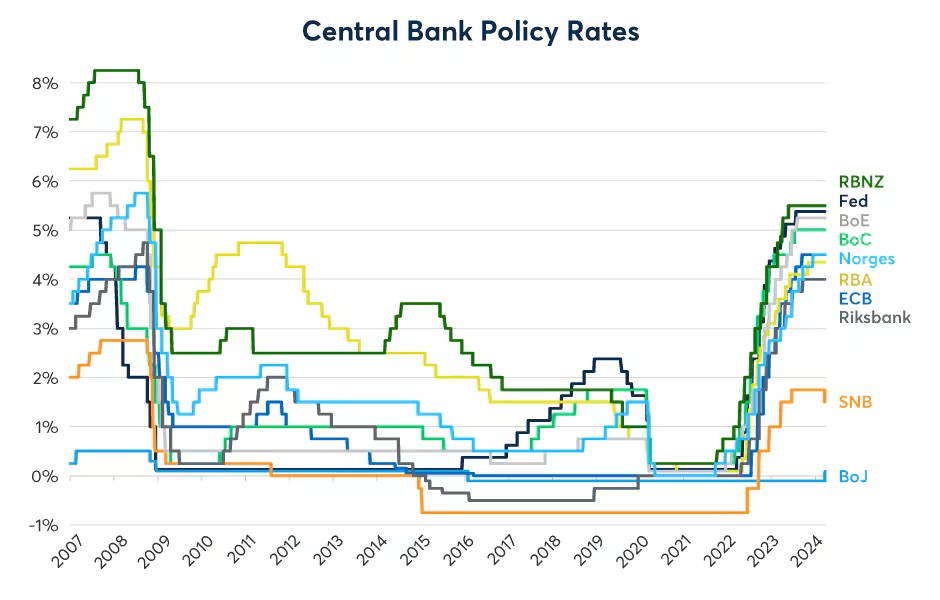

However, there is more to the story of the yen’s recent weakness than ending negative rates. There is the question of why the BoJ doesn’t appear to be taking additional steps to tighten monetary policy? In this regard, the BoJ is very much an outlier. Most other major central banks have raised rates by 400-500 bps. So far, the BoJ has done about 15 bps (Figure 2).

Figure 2: BoJ rates remain far below those of other central banks

Source: Bloomberg Professional (FDTRMID, CBAROVER, UKBRBASE, EURR002W, BOJDPBAL, RBATCTR, NOBRDEP, SWRATEI, SZLTDEP, SZLTTR, NZOCR) – Past performance is not indicative of future results

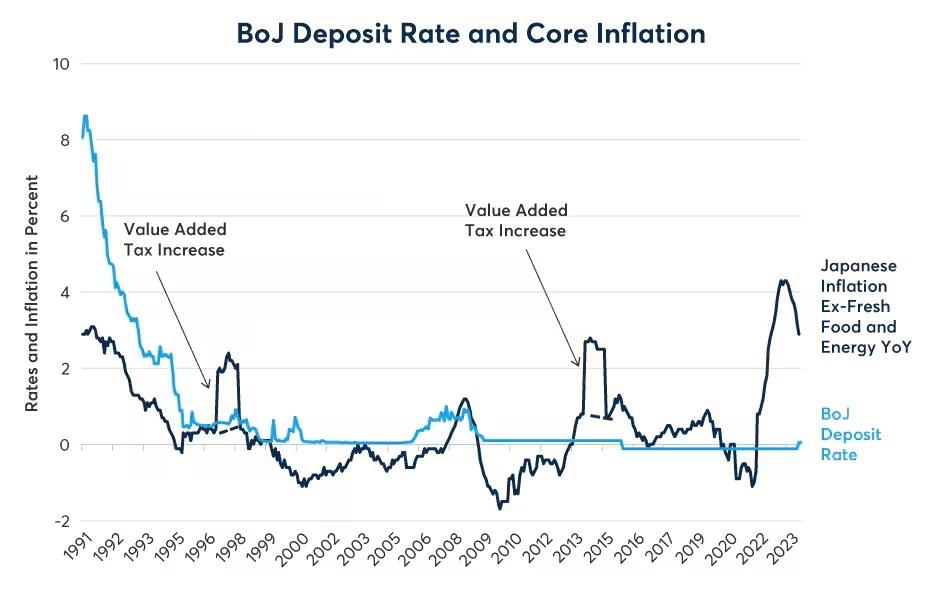

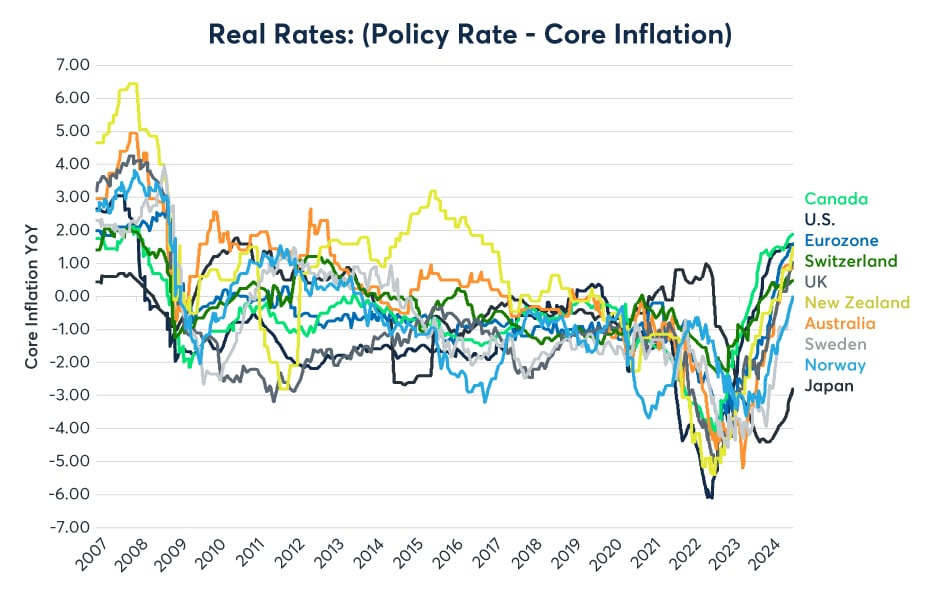

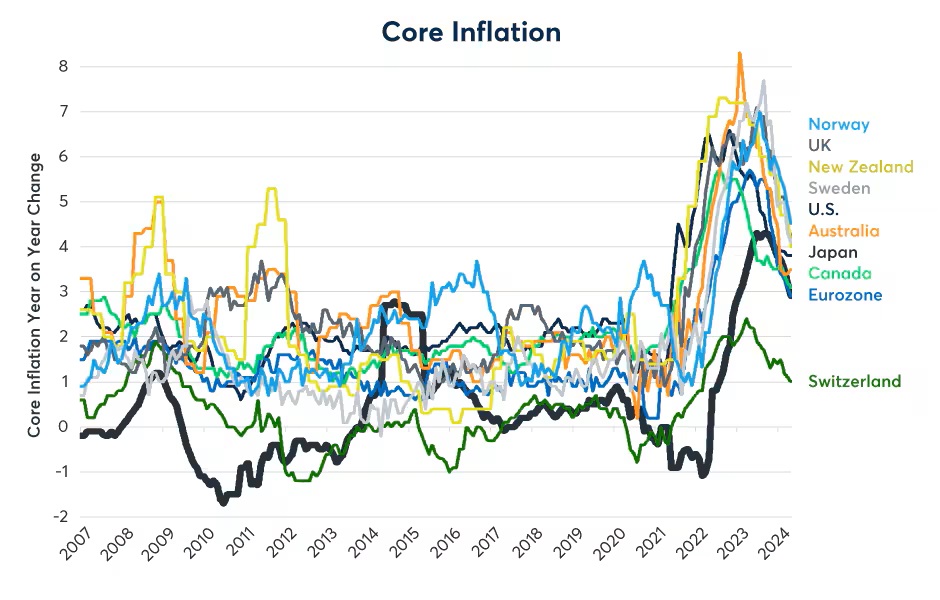

Japan’s core inflation rate remains at around 3%, off its peak but still fairly high (Figure 3). This puts the BoJ’s real rate at around -3%, far below real rates of peers like Australia, Canada, the eurozone, U.S. and U.K. where real rates are mostly in a range from zero to 2% (Figure 4).

Figure 3: Japan’s core inflation rate is falling but remains far above the BoJ’s policy rate

Source: Bloomberg Professional (BOJDPBAL, and pre-2008, JY0001M, and JPCNEFFE) – Past performance is not indicative of future results

Figure 4: Japan’s real rate of interest remains an outlier

Source: Bloomberg Professional (CPI XYOY, CACPTYOY, UKHCA9IC, CPIEXEMUY, JPCNEFEY, ACPMXVLY, NOCPULLY, CPEXSEYY, SZEXIYOY, NZCPIYOY) – Past performance is not indicative of future results

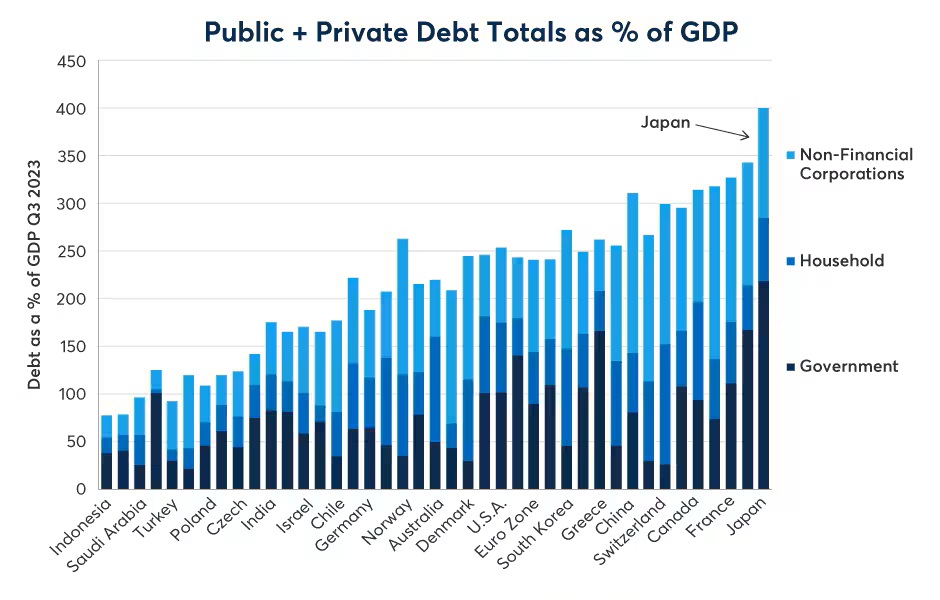

The answer to the BoJ’s reluctance to raise rates further could be down to Japan’s leverage ratios, which far exceed those of other countries. Japan’s public sector debt amounts to 220% of GDP, according to the Bank of International Settlement (BIS). Japan’s total level of private + public sector debt amounts to over 400% of GDP, compared to around 250% in the eurozone, U.S. and U.K. (Figure 5).

Figure 5: Japan has higher debt-to-GDP than any other country

Source: Bank for International Settlements (BIS) – Past performance is not indicative of future results

On the one hand, the BoJ may be reluctant to raise rates further for fear of widening the Japanese government’s budget deficit further by raising its cost of financing debt as well as concern over the possibility of contributing to financial stress in the Japanese private sector, where corporate debt amounts to over 115% of GDP.

On the other hand, after years of on-and-off deflation, +3% core inflation may be welcome news. Positive inflation can help to reduce debt and leverage ratios as has been happening in Europe and in the U.S. where debt-to-GDP ratios have been falling. The evolution of the debt ratio can be described by the following equation:

The higher inflation and real growth are, the faster debt shrinks as a percentage of GDP, so long as they are growing faster than the rate of interest on the debt and the pace at which new debt is accumulated. Japan hasn’t seen a lot of real GDP growth, so positive inflation is essential to keeping nominal GDP growth positive and debt levels stable or falling.

Japan’s inflation surge came later than the rise in consumer prices in the U.S. and Europe and didn’t peak as high as it did elsewhere (Figure 6). This may also explain the BoJ’s slow and cautious start to rate hikes.

Figure 6: Japan’s inflation wave was smaller and hit later than elsewhere in the world

Source: Bloomberg Professional (CPI XYOY, CACPTYOY, UKHCA9IC, CPIEXEMUY, JPCNEFEY, ACPMXVLY, NOCPULLY, CPEXSEYY, SZEXIYOY, NZCPIYOY) – Past performance is not indicative of future results

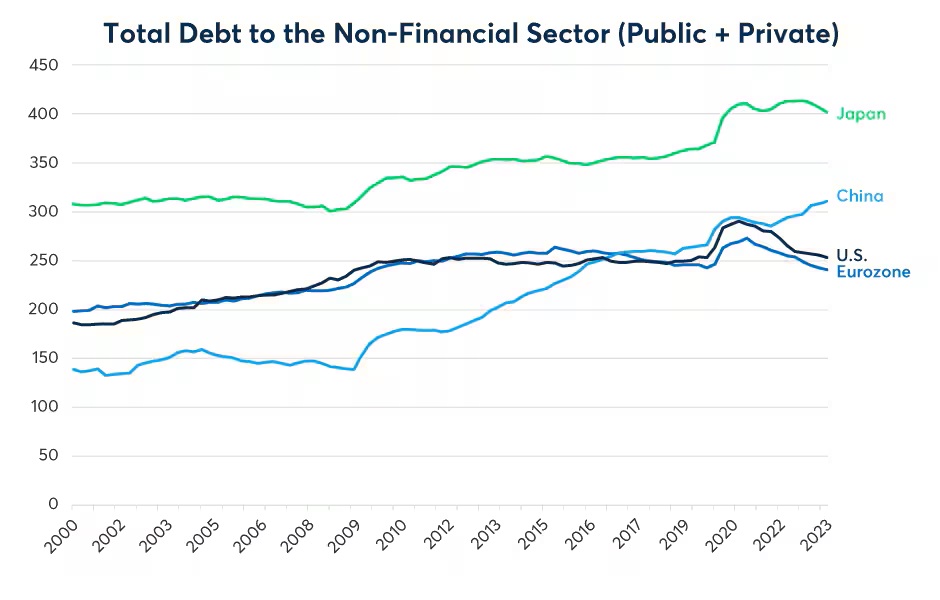

The period of high inflation has led to a deleveraging of the U.S. and eurozone economies since the end of 2020 that has largely bypassed Japan (Figure 7). U.S. public sector debt-to-GDP ratio peaked at 129% of GDP in Q4 2020 and is now down to 102% despite the U.S. rapidly accumulating new debt by running large budget deficits. This has been made possible by rapid growth of nominal U.S. GDP, which in turn resulted from strong growth and high inflation. The combined U.S. public and private sector debt has fallen from a peak of 290% of GDP in Q4 2020 to 253% today.

Figure 7: Higher inflation helped the U.S. and Europe to deleverage faster than Japan

Source: Bank for International Settlements (BIS) Total Debt to the Non-Financial Sector Database – Past performance is not indicative of future results

The eurozone has had a similar experience. Debt-to-GDP ratio peaked in Q1 2021 at 273% of GDP and is now down to 241%. Japan, which has had less inflation and therefore slower growth in nominal GDP, has not seen its leverage ratios change as dramatically. As such, the BoJ may be willing to tolerate higher inflation and a weaker currency to help its leverage ratios drift back to levels that are more common in other countries.

China, which not only avoided the post-COVID inflation surge but has actually seen close-to-zero inflation, offers an interesting counterpoint. Unlike Europe and the U.S., which had high inflation and falling debt-to-GDP ratios, or Japan, which has had moderate inflation and stable debt-to-GDP ratio, China’s leverage ratios have been increasing amid relatively unchanged prices.

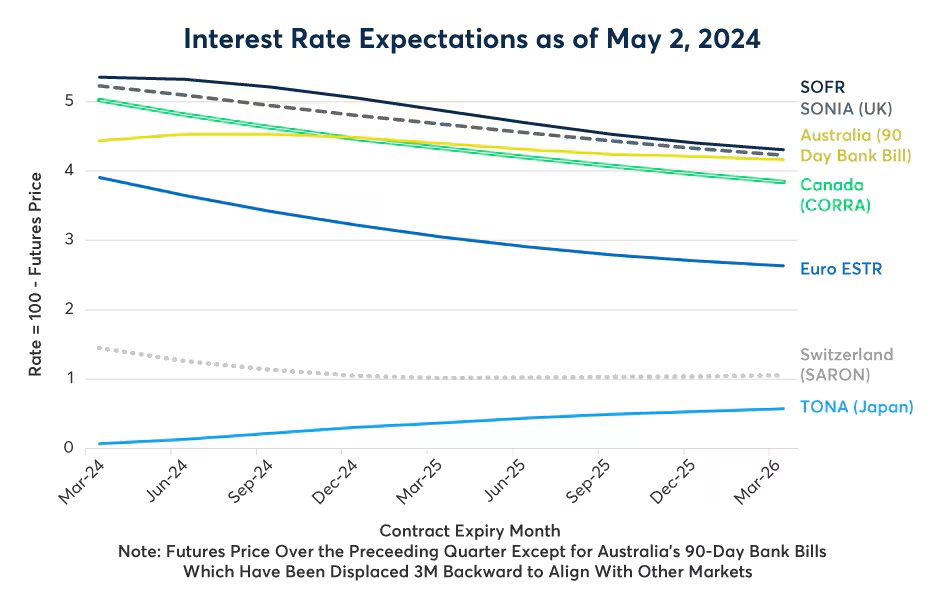

Figure 8: Interest Rate Expectations as of May 2, 2024

Source: Bloomberg Professional – Forecasts are not an indicator of future performance, and any investments are subject to risks and uncertainties.

One thing is certain: interest rate traders see BoJ policy evolving in a very different manner than that of its peers. For starters, futures curves for central bank policy in the U.S., the eurozone, U.K., Switzerland, Australia and Canada all point to a likelihood of eventual policy easing.

By contrast, with the BoJ target range currently at 0-10 bps, the Japanese forward rate market is positioned for higher rates. However, given Japan’s debt levels and the tenuousness of Japan’s return to positive inflation, rates traders in Japan aren’t pricing the 200-500 bps of rate hikes that have occurred elswhere. Rather, they are pricing that the BoJ might bring its policy rate up towards 0.5% (Figure 8). If the BoJ were to tighten policy as other central banks begin to ease, that might support the yen and help to end its multi-year bear market.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.