Creation/Redemption Process — The Primary Market

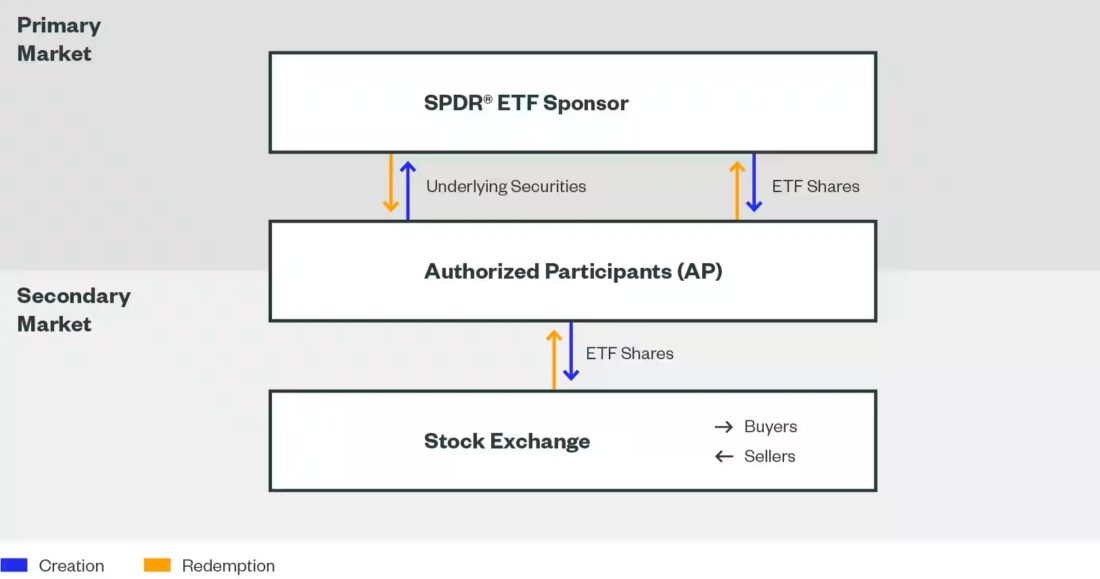

Becoming familiar with the ETF creation/redemption process is key to understanding the true extent of an ETF’s overall liquidity and achieving more efficient execution from a wider selection of funds. The creation and redemption process for ETFs takes place in the primary market and is facilitated by authorized participants (APs). APs are US-registered, self-clearing broker dealers who regulate the supply of ETF shares in the secondary market.

Creation is the process by which APs introduce additional shares to the secondary market. During this process, APs deliver the underlying securities to the fund sponsor in return for ETF shares. For redemptions, APs deliver ETF shares to the fund sponsor in return for the underlying securities. These transactions are executed in large increments known as unit sizes, which vary from 10,000 to 600,000 shares.

The ability to introduce additional shares into the marketplace on a daily basis demonstrates precisely why ETF trading volume is not an all-encompassing measure of the fund’s overall liquidity. To understand the full liquidity of an ETF, investors must also consider the liquidity of its underlying securities.

Why Does an AP Create or Redeem ETF Shares?

There are a number of reasons why an AP creates or redeems ETF shares, including: arbitrage, inventory management, customer facilitation, and create to lend. The two reasons that are the most applicable to investors are customer facilitation and arbitrage.

- Customer Facilitation: APs have the ability to create or redeem ETF shares for clients in order to access additional liquidity beyond the secondary market. For example, if a pension fund is interested in acquiring $50 million of ETF XYZ, they may consider working with an AP to facilitate a creation.

Additional details can be found in Section 3: Buying and Selling an ETF - Arbitrage: APs can create or redeem ETF shares in order to take advantage of potential arbitrage opportunities in the market. For example, if shares of ETF XYZ are trading at $55.00 in the secondary market and the value of the underlying securities is $54.95 per share, there is an inherent arbitrage opportunity.

To realize this opportunity, the AP would sell ETF shares at $55 and hedge their position by buying the corresponding underlying basket of securities for $54.95, thus locking in the $0.05 profit. The AP can deliver the underlying securities to the fund sponsor in return for ETF shares in order to flatten out their short position in the ETF. This hypothetical example results in a $0.05 profit for the AP.

The key takeaway for investors is that this process keeps the ETF market price in line with the value of its underlying securities due to the consistent arbitrage opportunity for APs and institutional trading desks.

Figure 1: The ETF Creation/Redemption Process

Bid-Ask Spreads

The ask is the price at which an investor can buy ETF shares, and the bid is the price at which they can sell the shares. The difference between the bid and the ask is the spread, which indicates the overall cost of transacting in any security (plus any applicable brokerage commission costs).

What Does the Bid-Ask Spread Represent?

ETF bid-ask spreads reflect execution costs, market risk, and the bid-ask spreads of the underlying securities in the ETF basket. These variables are all considered when institutional trading desks make markets for investors. Like most businesses, the cost to the end consumer is highly correlated with input costs. In this respect, ETF trading is no different from any other business. Therefore, ETF traders need to account for different categories of cost when facilitating ETF trades:

- Creation/Redemption Fee: This is a fixed cost that the ETF sponsor charges an AP to create or redeem ETF shares. The fee varies amongst funds and is a cost per order, not per creation or redemption unit. Fees generally range from several hundred dollars to several thousand dollars, depending on the ETF and its asset class.

- Spread of the Underlying Securities in an ETF Basket: Bid-ask spreads of the underlying securities directly impact the costs to market makers to trade ETFs. These costs tend to be greater for less liquid, esoteric asset classes, such as emerging market equities or high-yield credit.

If a market maker has to obtain a portion of the ETF constituents on the secondary market to then deliver into the fund as part of the basket process, the cost of acquiring those names should be reflected in the ETF’s bid-ask spread — as costs are traditionally passed through to the end customer. - Risk: At times, market risk can have a major impact on spreads, especially during periods of elevated market volatility. During these times, market makers are forced to widen their spreads in order to include a buffer for the additional market volatility.

To hedge their risk and make orderly markets when trading, market makers will use an array of tools — underlying securities or correlated proxies, such as index futures or other ETFs. This hedging cost will be included in an ETF’s spread and also passed along to investors trading in the secondary market.

How Does an ETF’s Spread Change Over Time?

Although there are certainly a number of factors that contribute to the spread of an ETF, we believe there is one major factor that tends to compress spreads — secondary market trading volume in the ETF. Over time, as secondary market trading volume increases, there is a high correlation with tightening spreads.

As volume in an ETF rises, competition among market participants may compress spreads and allow investors to transact in a more cost-efficient manner in the secondary market. As ETFs mature, they may trade within an “arbitrage band” determined by the costs incurred by APs when creating and redeeming ETF shares.

Premiums/Discounts and Why They Occur

In some cases, ETFs can trade above or below their intraday Net Asset Value (iNAV). This discrepancy is known as a premium or discount in the fund. ETFs may trade at premiums or discounts to their iNAVs due to several factors, including the bid-ask spread of their underlying securities, execution costs, investor sentiment, and market risk.

With respect to ETFs with international equity underlying, we tend to see greater premiums/discounts due to higher transaction costs and additional market risk. When analyzing these premiums and discounts, investors should keep in mind the difference between the trading hours of the underlying securities and those of the US-listed ETFs.

ETFs with fixed income underlying securities generally trade at a premium to NAV under normal market conditions. The main reason for this phenomenon is that fixed income ETFs trade at the midpoint (between the bid and the ask) of their underlying securities, while their NAVs are priced using the bid side — causing the differential, as the midpoint will be greater than the bid price.

However, during fear-driven market environments (taper tantrum, debt ceiling debate, or the oil selloff, for example), fixed income ETFs may see their premiums diminish and trade at a discount to NAV. In this case, the discount conveys market sentiment, as investors use the ETF as a price discovery tool.

It also reflects the risk that market makers face when selling the underlying cash bonds, as during bouts of volatility, some of the more illiquid fixed income securities may not be actively priced or traded.

Buying and Selling an ETF

There are two layers of liquidity within an ETF — available liquidity in the secondary market and liquidity of the underlying securities. In order to access all available pools of ETF liquidity, it is important to understand the various ways that investors can buy and sell ETFs.

What Is the Secondary Market?

The majority of ETF orders are entered electronically and match orders placed by natural buyers and sellers in the secondary market, where participants post bid and offer quotes at price levels that they are willing to buy or sell a particular number of shares at for a given ETF.

There are a number of different order types that can be used in the secondary market. Many investors utilize limit orders, which are orders to buy or sell a stated amount of a security at a specified price or better. The below example, which uses a hypothetical secondary market for ETF XYZ, reveals why investors should utilize limit orders when buying or selling an ETF:

| XYZ Bid | XYZ Ask | ||

| Shares | Price ($) | Price ($) | Shares |

| 1000 | 36.11 | 36.25 | 1000 |

| 1000 | 36.1 | 36.3 | 3000 |

| 10000 | 35.96 | 36.35 | 12000 |

| 3000 | 35.95 | 36.39 | 4000 |

| For illustrative purposes only. | |||

If an investor placed a market order for 20,000 shares of XYZ, their average execution price would be $36.35, or $0.10 above the best offer at the time of execution. This is due to the fact that only 1,000 shares are offered at the best offer price of $36.25. The remainder of the trade is then executed at subsequent price levels until it has been fully executed. As a result, a market order for 20,000 shares would sweep through the available liquidity — in this case, at all four levels shown.

On the other hand, the investor could place a limit order at the best offer of $36.25, which would immediately execute 1,000 shares at that price. The remaining 19,000 shares would be bid in the secondary market at the same level until the order is filled.

This example highlights why market orders should generally be avoided when trading ETFs, especially with those that are more thinly traded. Although market orders provide faster execution of the entire order, the lack of control over the price can lead to unintended trading slippage.

With limited orders, the tradeoff is less immediate execution, but greater control over price. But one risk with limit orders: the entire order may not be filled. To increase the probability that the entire trade will be filled, investors can enter more aggressive limit orders at price points higher than that of the best offer in the secondary market.

How to Handle Large Trades

Despite the efficiencies of the secondary market, investors may face situations where their trades outsize the available liquidity in the secondary market. In these circumstances, it may make sense to execute through an institutional trading desk. There are two common ways to execute large ETF orders with trading desks:

- Risk Trade: One way that investors can interact with an institutional trading desk is through a risk trade. With a risk trade, the trading desk will quote a market for a given ETF at a given size.

For instance, for a client looking to buy 125,000 shares of ETF XYZ, the desk will calculate its risk and offer a price at which it is willing to sell the 125,000 shares to the client. If the client finds the price agreeable, then the trade is executed OTC (over the counter), and the liquidity provider must print the trade to the consolidated tape.

The reason this is referred to as a risk trade is because once the trade is executed, the trading desk assumes the market risk (ability to hedge the position and limit capital loss on the trade from market) of the position. In the event that the trade is large enough, they may create or redeem shares to unwind their risk. This may be advantageous to clients looking to execute their orders quickly at one price. - Creation/Redemption: Investors can also work with a trading desk or AP to place a creation order on their behalf with the fund sponsor.

In this scenario, the price the client pays for the shares is based upon the closing NAV, as well as any implicit costs that the AP incurs in the process of creating shares. As previously discussed, these costs include executing the underlying securities and the creation fee charged by the ETF sponsor.

Each of these scenarios allows investors to access deeper pools of liquidity than those offered by the ETF itself in the secondary market. The main difference between the two is that the investor transfers market risk to the authorized participant and receives an immediate execution price in a risk trade, as opposed to creating ETF shares and taking on market risk until the end of day. The reason for using one over the other depends on the goals of the investor.

| Pros | Cons | |

| Market Order | Order is usually filled quickly | No control over execution price |

| Limit Order | Control over execution price | Chance order will not be filled |

Making Trading More Efficient

ETF usage continues to accelerate as intermediary and institutional investors embrace ETFs for their inherent benefits, such as low cost, tax efficiency, intraday liquidity, and transparency.1 Understanding the unique structure of ETFs allows investors to buy and sell them more efficiently.

Through strong relationships with authorized participants, market makers, liquidity providers, execution trading desks/platforms and stock exchanges, the SPDR Capital Markets Group plays an active role in supporting competitive markets and maintaining the SPDR ETF liquidity ecosystem.

The team’s insight into primary and secondary market activity — as well as access to numerous proprietary pre-trade liquidity analytics tools — can help you to evaluate execution strategies and meet your objectives, even in volatile markets.

3 Key Takeaways to Master ETF Trading

ETFs Trade Like Equity Securities:

Investors and advisors should remember that an ETF is purchased, sold, and settled like an equity security. When buying or selling an ETF, investors should consider all of the factors they would when buying or selling a stock, as well as additional factors, like the total overall liquidity of the ETF.

Extreme Volatility Means Information Flow Can Be Less Efficient:

Under the efficient markets’ hypothesis, the stock market is viewed to be efficient and to reflect all publicly available information on securities. In periods of distress, the markets typically become less efficient. As a result of uncertainty in the broader markets, one may see bid-ask spreads or premiums/discounts to ETF NAVs widen for periods of time. Typically, these are temporary events. The extent to which the spreads widen is typically directly related to the perceived risk or volatility of the asset class.

ETFs Trade Effectively Even in Volatile Environments:

In the wake of periods of volatility, ETF trading volumes have increased sharply as investors look to ETFs for their key attributes of transparency and liquidity. ETFs can also function as price discovery tools, providing insights into the market’s view on correct market pricing, even during periods when the underlying liquidity for an asset class is diminished.

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: Bonds

As with all investments, your capital is at risk.