Originally Posted 11 Mar 2024 – Navigating equities in the last mile of inflation

Key Takeaways

- Amidst rising geopolitical uncertainty and ambiguity around the timing of rate cuts, investors should look to take a balanced approach between valuation and earnings risk.

- Investors should not simply load up on the Magnificent 7, value stocks are known to outperform in softer and harder landing environments, rendering them important for a balanced US equity allocation.

- Firepower abounds for Japanese equities, with the market set on the theme of further vitality in the economy on rising wages and improving capex.

- The changing landscape of Emerging Markets opens a plethora of opportunities.

- Related Products WisdomTree Global Quality Dividend Growth UCITS ETF – USD Acc, WisdomTree US Quality Dividend Growth UCITS ETF – USD Acc, WisdomTree Eurozone Quality Dividend Growth UCITS ETF – EUR Acc, WisdomTree US Equity Income UCITS ETF, WisdomTree Emerging Markets Equity Income UCITS ETF, WisdomTree Japan Equity UCITS ETF – USD Hedged

Navigating the complexities of geopolitical tensions and economic uncertainties, monetary policy continues to dominate sentiment and drive equity market performance in 2024. Investor expectations for rate cuts this year appear to have diverged from central bank communication, making for a challenging rate environment.

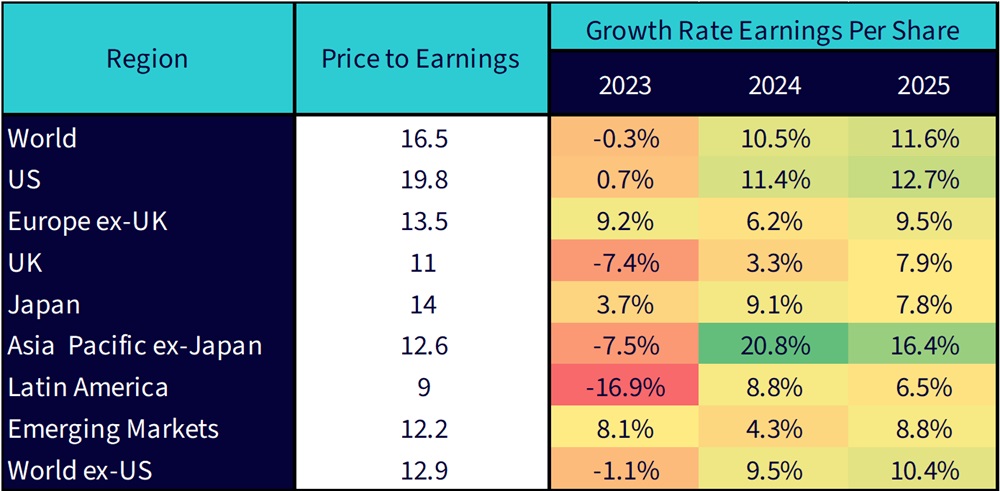

Figure 1: Earnings per share calendar year growth rate

Sources: MSCI, FactSet, WisdomTree, as of 31/12/2023. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Earnings expectations for the US remain high

Investor expectations for earnings in the US are approximately 11.4% over 20241. This could be achieved if economic data and consumers stay strong. At the same time, lower inflation, improving real wage growth and declining rates could support a late-cycle recovery. US corporates face a potential squeeze on gross margins as inflation falls and the reopening boom in services consumption fades. Corporates in the tech sector remain cash rich, while small businesses are paying more than 9% for working capital.

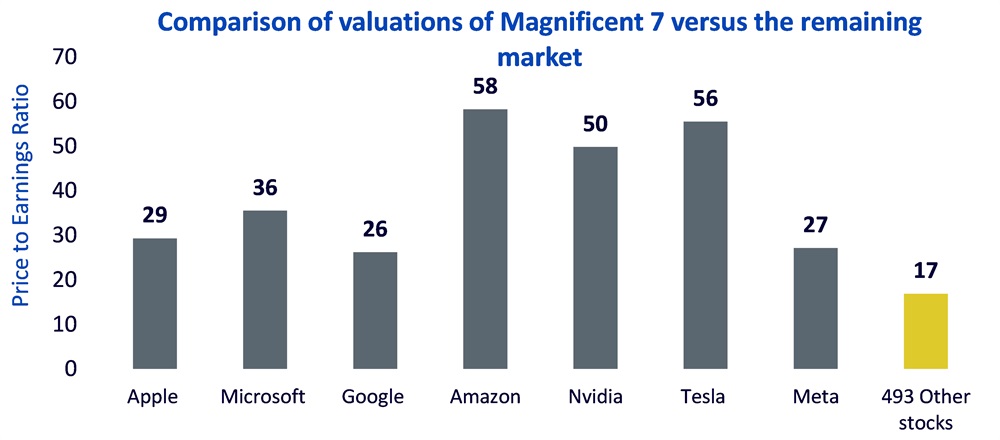

The narrow bull market

The stocks within the Magnificent 7 have higher multiples than the median of 493 remaining stocks in the market (see Figure 2). 2023 was the narrowest year in equity markets since the late 1980s, with returns concentrated in the hands of a few tech titans. Amidst a weaker economic backdrop, we expect the leadership to continue to be narrow, with the large tech stocks’ track record of higher profitability and strong balance sheets performing well.

Figure 2: Comparison of valuations of Magnificent 7 vs. the remaining market

Sources: Bloomberg, WisdomTree, as of 24/01/2024. Historical performance is not an indication of future performance and any investments may go down in value.

However, investors should not simply load up on the Magnificent 7. Value stocks deserve attention. Investors have been underweight in value for several years, yet value stocks are known to outperform in softer and harder landing environments, rendering them important to consider for a balanced US equity allocation.

Eurozone – looking for the rebound

European equities returned 22% last year2. Unlike the US, in Europe there has been more breadth in equity market performance. Europeans have been hit harder by the recent rate hikes owing to the higher proportion of mortgages and long-term loans with floating rates.

Despite facing the consequence of higher rates, excess household savings currently amount to 14% of annual incomes, up from 11% two years ago3. Real wages were falling; now they are growing at a pace of 3%, marking the fastest pace in three decades and giving consumers ample spending power. There are initial signs that the worst might be over and momentum in the economy is beginning to stabilise. Growth should pick up modestly in 2024 as falling inflation boosts real incomes, global demand gathers steam, industrial de-stocking ends and monetary easing comes to fruition. Amidst the current backdrop, equities that stand to outperform are long duration—quality stocks with a growth tilt. The European market has been transitioning to a more growth-oriented bias. European equities currently trade at the lowest valuation (that is, a price-to-earnings (P/E) ratio of 13.5x) compared to developed market equities4 alongside a higher dividend yield of 2.65%.

Firepower abounds for Japanese equities

Japanese equities ended 2023 on a high note. There are a number of catalysts in place to fuel Japan’s equity market rally in 2024 which include – increasing capex5 & higher wage growth, revamping the Nippon Individual Savings Account (NISA) and corporate Japan’s ongoing reform initiatives. Recent inflation data continues to slow as the prior high import costs work through the system amidst soft domestic demand.

The yen may appreciate in 2024 on narrowing US-Japan interest rate spreads. A stronger yen could renew concerns over a possible negative effect on Japanese corporate earnings. However, a strong yen may not be too much of a hindrance to Japanese equities, with the market set on the theme of further vitality in the economy on rising wages and improving capex. The Bank of Japan is likely to exit negative interest rates in H2 2024, taking into consideration the spring wage negotiations. However, softer economic data could delay policy normalisation.

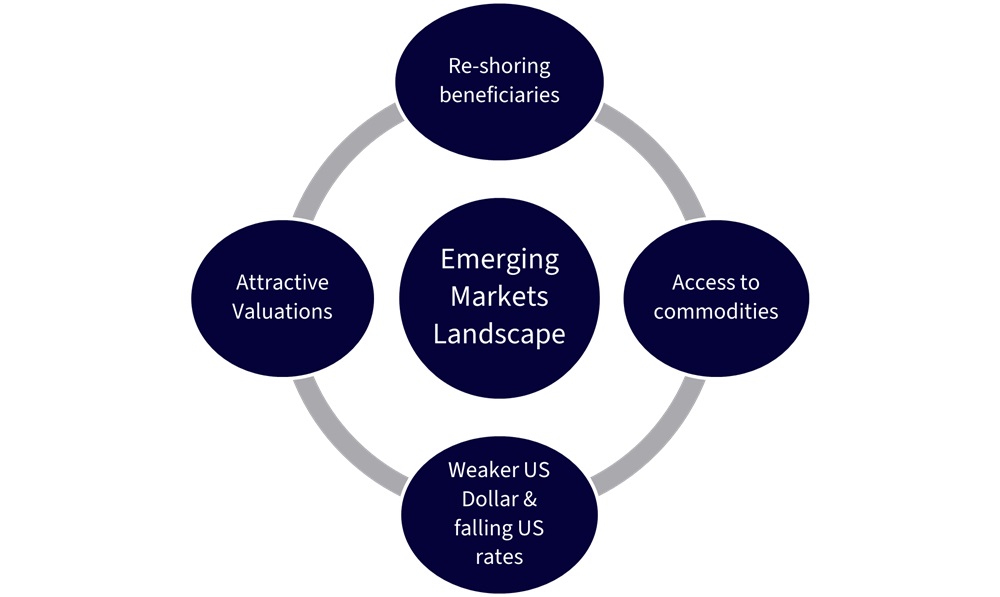

The changing landscape of emerging markets

There is a traditional view among investors that markets reflect the real world. For emerging markets (EM), it is certainly shaping up to be the case. The old view of EM as a tactical investment, shunned during times of economic uncertainty, fails to adapt to how significantly the EM landscape has changed over the decade.

Since the COVID-19 pandemic, the re-wiring of globalisation—often termed ‘re-shoring’—has changed the landscape of manufacturing production, thereby benefitting the EM landscape. Rising geopolitical tensions and disrupted supply chains have led companies to move their supply chains closer to home. Mexico, owing to its proximity to the US, has also benefitted. India, owing to its large pool of working-age population alongside lower labour costs, has been an important beneficiary of this long-term trend.

Figure 3: The emerging markets landscape

Source: WisdomTree, as of 21/01/2024.

Decarbonisation is expected to be an important driver of demand for commodities. EMs such as South Africa, Mexico, Chile and Brazil stand to gain from the abundance of commodity supply.

Following years of underinvestment in the commodity complex, the commitment to decarbonise the global economy is likely to be a boon for demand, as green technologies are commodity intensive.

Strong fiscal position and inflation control

The fiscal position of EM economies has strengthened since 2013, with a current account balance above developed markets, less dollar-denominated debt and higher foreign exchange reserves. EM central banks have remained disciplined this cycle, staying ahead of the curve in raising rates. As inflation abates, rates are expected to decline, serving as a tailwind for EM consumers.

Mind the gap

Emerging market profit margins are near cyclical lows and have plenty of room to rebound. P/E valuations for EM equities remain below their long-term averages, and the P/E gap to global equities is close to its highest level in 20 years6. We expect a recovery in earnings, a weaker US dollar and monetary easing to support performance of EM equities in 2024. Our factor preference within EM remains tilted towards the dividend and value factor.

Conclusion

The long-term outlook for equity returns remains attractive. Yet, after more than a decade, the implied earnings yield of global equities is facing stiff competition from cash and fixed income yields. However, now that inflation is settling down and expectations for monetary easing are taking shape, equities will enable investors to generate real returns above inflation to meet their long-term goals. Cash, unfortunately, hasn’t beaten inflation for any of the past 12 years. Amidst rising geopolitical uncertainty, ambiguity around the timing of rate cuts and economic uncertainty, investors should look to take a balanced approach between valuation and earnings risk.

Sources

1 MSCI, Factset, WisdomTree as of 31 December 2023.

2 Performance of EuroStoxx 600 from 31 December 2022 to 29 December 2023.

3 FactSet, WisdomTree, as of 29 December 2023.

4 Bloomberg, WisdomTree, as of 24 January 2024.

5 Capex refers to capital expenditure

6 Bloomberg, WisdomTree, as of 31 December 2023.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.