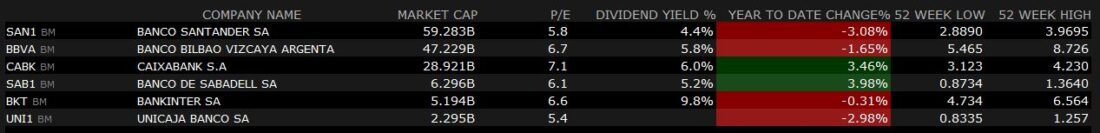

The IBEX 35 is an index in which financial stocks have the highest weightings and account for approximately 30% of the index. The banks in the IBEX 35 are Banco Santander (SAN1), BBVA (BBVA) with a market cap of EUR 50 billion, Caixabank (CABK), Banco Sabadell (SAB1), Bankinter (BKT) and Unicaja Banco (UNI1).

The ECB started to increase interest rates on 27 July 2022 from their existing levels of where the deposit facility rate was – 0.50%, the main refinancing operations rate was 0.00%, and the margin lending facility was 0.25%. Since the start of that process, interest rates have risen constantly until reaching rates above 4%. As of yesterday, the rates reached the following levels: deposit facility rate at 4%, the main refinancing operations rate at 4.50% and the margin lending facility at 4.75%.

The increase in interest rates has propelled performance by the banks as they are now providing mortgages at higher interest rates, obtaining better profitability on their long liquidity, and achieving lending spreads not seen in quite some time.

Source: IBKR TWS. Past performance is not indicative of future results.

Since July 27, 2022, the financial stocks in the index achieved the following performance as of November 16, 2023:

- SAN1 increased 48.28%

- BBVA increased 96.35%

- CABK increased 35.39%

- SAB1 increased 88.67%

- BKT increased 25.45%

- UNI1 increased 10.68%

In that same period, the IBEX35 index has lost -15.96%. As we can see, all the banks have outperformed the index as benchmark by a substantial margin. Obviously, investing in these stocks versus the index would have been a profitable trade if one had begun this strategy as the start of the interest rate hike cycle.

Although we do not know if interest rates will continue to rise, it does seem that the increases will not be as pronounced as they have been during this period based on recent inflation data. December inflation was 2.9%, and although it is still above the 2% ECB target, it has dropped considerably from 10.6% in October 2022.

In conclusion, Spanish banks in general have performed well since interest rates began to rise.

The current situation and some additional data is shown below:

Source: IBKR TWS. Past performance is not indicative of future results.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.