Originally Posted 12 Mar 2024 – Riding the crests and weathering the troughs: navigating thematic investing in 2024

Key Takeaways

- 2023 split the thematic landscape into winners and losers, creating challenges and opportunities for investors.

- AI, cloud computing and cybersecurity were among the hot themes last year and are likely to remain so in 2024.

- Performance of themes within energy transition have suffered lately but there are notable undercurrents pushing the megatrend on.

- The impact of AI in biotechnology is underappreciated in markets, making it an interesting theme for investors to consider in 2024.

- Related Products WisdomTree Artificial Intelligence UCITS ETF – USD Acc, WisdomTree Cloud Computing UCITS ETF – USD Acc, WisdomTree Cybersecurity UCITS ETF – USD Acc, WisdomTree BioRevolution UCITS ETF – USD Acc

Tesla’s journey from the unveiling of its first electric vehicle in 2008 to becoming a stock market darling in 2020 and weathering the storm of a major pullback in 2022 showcases the dynamic nature of thematic investing. As technological adoption, regulatory support, changing consumer preferences and macroeconomic forces converge themes go through cycles of highs and lows, presenting both challenges and opportunities for investors.

In 2023, the performance of thematic investing was divergent, with some themes experiencing strong gains whilst others languished. As we enter 2024, investors face the task of navigating two paradigms: riding the crests of themes with positive momentum and weathering the troughs of underperformers or identifying potential entry points.

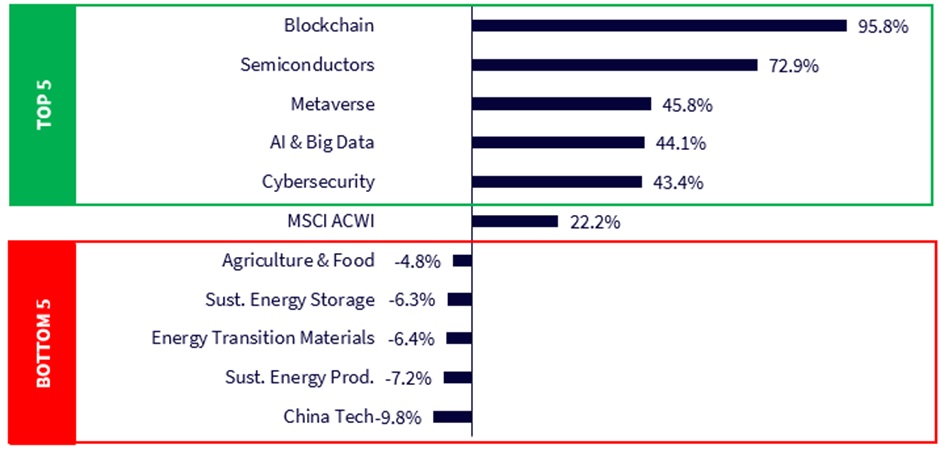

Top five and bottom five themes by performance in 2023

Source: WisdomTree, Morningstar, Bloomberg. All data as of 31 December 2023 and based on WisdomTree’s internal classification of thematic funds. Performance is based on monthly returns from Bloomberg and Morningstar More information on the WisdomTree Thematic classification can be found in the Appendix. Historical performance is not an indication of future performance, and any investments may go down in value.

Riding the crests

Artificial Intelligence (AI)

In our last outlook, published in October 2023, we emphasised how AI will fuel growth across megatrends. In the months since then, we have seen numerous examples of this narrative unfold. The integration of AI into various gadgets showcased at CES 2024 indicates the mainstream adoption of this technology across industries. In the automotive sector, for example, digital assistants powered by generative AI are enhancing user experience and safety. With $74.5 billion expected to be invested in AI by automotive companies by 20301, there is much to look forward to in this sector. 2024 could be a year when we see more use cases of AI across industries, pushing the revolution that started in 2023 into its next phase.

Cybersecurity

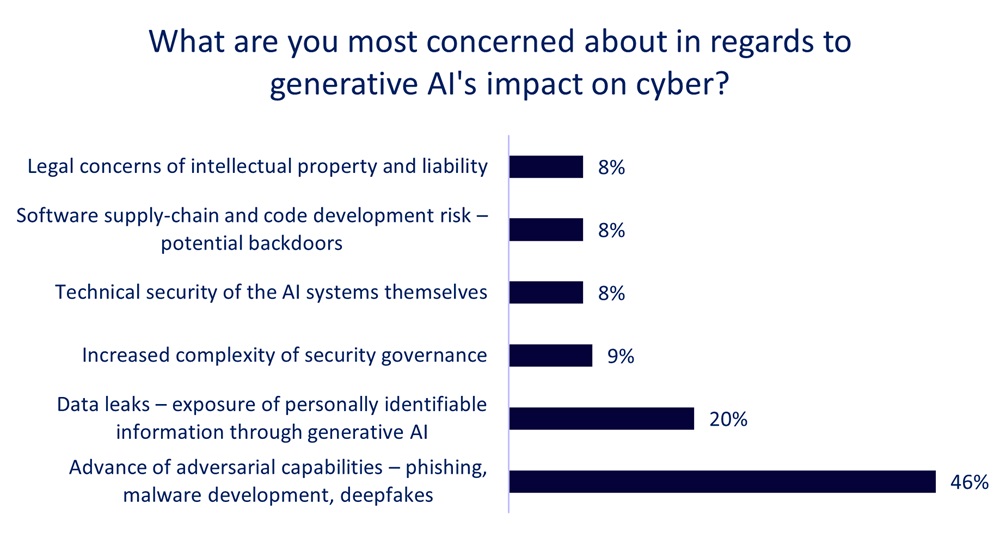

The World Economic Forum’s Global Cybersecurity Outlook Report emphasises the urgent need to address cybersecurity resilience, especially for small organisations facing increased vulnerability due to emerging technologies – like generative AI. As the proliferation of AI continues, cybersecurity remains a top priority, ensuring sustained market recognition for this theme.

Source: World Economic Forum Global Cybersecurity Outlook 2024. Based on a survey of 120 executives at the World Economic Forum’s annual meeting on cybersecurity.

Cybersecurity was among the top performing themes in 2023 and the case for us to continue investing in this space has only become stronger in 2024 with AI-powered attacks becoming more sophisticated than ever.

Cloud Computing

Bessemer Venture Partners’ ‘State of the Cloud 2023’ report highlights the transformative impact of large language models on the SaaS landscape, predicting that AI native cloud companies will accelerate the path to $1 billion in revenue by 50%. The interdependence of AI, cybersecurity, and cloud computing makes us believe that the fates of these three themes will remain intertwined in 2024.

Weathering the troughs

Energy Transition

According to the International Energy Agency, the world added 50% more renewable energy capacity in 2023 than in 2022, and the next five years are expected to see the fastest growth yet2. More policy impetus has come from COP283 where leaders have agreed to triple renewable energy capacity by 2030.

But performance for green themes in 2023 painted a colourless story. For themes like renewable energy and battery storage this has created a stark contrast between the poor market performance and the strong underlying fundamentals. We expect this dynamic to attract the attention of more investors in 2024.

Biotechnology

The biotech sector experienced its third consecutive year of poor performance in 2023, driven by challenges in developing and commercialising innovative therapies. However, increased merger and acquisition activity, coupled with advancements in AI-driven drug discovery, indicate a potential reversal of fortunes in 2024.

The biotech sector, despite its recent struggles, holds immense potential for long-term growth and innovation. Biotechnology companies play a critical role in developing life-saving drugs, therapies, and treatments for various diseases and medical conditions. However, the road to success in biotech is often fraught with challenges, including lengthy regulatory approval processes, high research and development costs, and competitive pressures.

One of the key factors contributing to the recent underperformance of the biotech sector is the uncertainty surrounding the success of individual drug candidates and the regulatory landscape. Biotech companies invest significant resources in research and development, with no guarantee of success. Many promising drug candidates fail to receive regulatory approval, or achieve commercial success, leading to financial setbacks for investors.

Despite these challenges, there are several reasons for optimism in the biotech sector in 2024. One notable trend is the increase in merger and acquisition (M&A) activity, driven by large pharmaceutical companies seeking to expand their product portfolios and pipelines. M&A transactions provide biotech companies with access to additional resources, expertise, and capital, which can accelerate the development and commercialisation of innovative therapies.

In addition, advancements in artificial intelligence (AI) are revolutionising the drug discovery process and offering new opportunities for biotech companies. AI algorithms can analyse large datasets, identify potential drug candidates and predict their efficacy and safety profiles with greater accuracy than traditional methods. This can significantly reduce the time and cost of bringing new drugs to market, improving the overall efficiency and success rate of drug development programs.

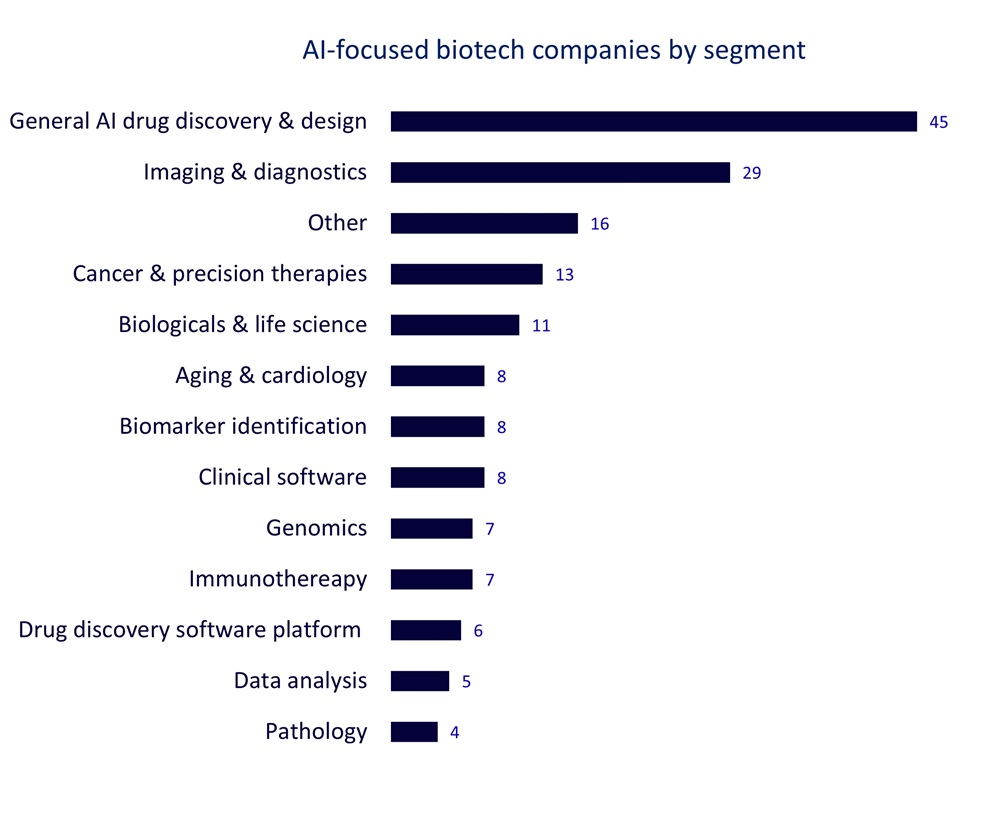

Source: WisdomTree, BioPharmGuy Company Database as of January 2024, https://biopharmguy.com/

Several biotech companies are already leveraging AI technology to accelerate their drug discovery efforts. For example, Exscientia has developed an AI-generated drug candidate for Obsessive Compulsive Disorder that is currently in clinical trials, marking a significant milestone in AI-driven drug discovery. Similarly, Recursion Pharmaceuticals has developed an AI platform called RecursionOS, which uses large language models to streamline the drug development workflow.

Moreover, the intersection of AI and biotechnology is leading to the emergence of new applications and solutions that promise to revolutionise healthcare and improve patient outcomes. Companies like Renalytix, IXACO and CellChorus are developing AI-based tools for risk assessment, neuroimaging, biomarker identification and single-cell analysis, expanding the scope and impact of AI in biotech beyond traditional drug discovery.

Therefore, we see biotechnology as an underappreciated story with immense potential in the year ahead.

Conclusion

Thematic investing is easy and hard at the same time. It’s easy because, in theory, investors should simply commit to a theme and then sit back, let the megatrend unfold and returns will eventually accrue. However, it’s hard because it can be a bumpy ride. But with the bumps come opportunities, opportunities to change the world and achieve worthwhile returns. Striking a balance between playing momentum and identifying underappreciated themes may be the way to go in 2024.

The full outlook can be viewed here.

Sources

1 Quoting EY from CES 2024.

2 International Energy Agency, January 2024.

3 United Nations Climate Change Conference in Dubai, UAE, from 30 November to 12 December 2023.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.