From SIA Charts

1/ Starbucks Corp (SBUX)

2/ Candlestick Chart

3/ Point and Figure Chart

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Starbucks Corp (SBUX)

Courtesy of SIA Charts

SIA Charts’ relative strength rankings help investors manage risk by identifying stocks and sectors which are underperforming relative to their peers and/or their benchmarks and should potentially be avoided. Staying away from stocks that are not attracting capital can help investors to avoid areas at higher risk of absolute declines and relative underperformance and to reduce negative event risk.

Past performance is not indicative of future results

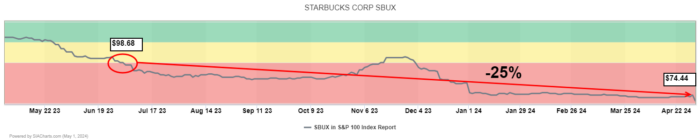

Starbucks Corp (SBUX) shares dropped nearly 16% yesterday following their earnings release for fiscal Q2 which was worse than anticipated and marked a historically weak quarter. Starbucks was already in the Unfavored zone of the SIA S&P 100 Index Report and fell 7 more spots yesterday to the 100th ranking out of 103 investments. Starbucks has been in the Unfavored zone since June of last year and is down around -25% during this time period. SIACharts’ Relative Strength rankings can help investors identify which stocks in a universe are underperforming against their peers and could potentially help stay away from earnings misses like Starbucks experienced yesterday.

2/

Candlestick Chart

US same-store sales dropped by 3% compared to an expectation of more than 1.2% as cautious consumer spending and a deteriorating economic environment weighed on customer traffic. Similarly, China experienced a decline of 11% in sales against an expected 2%. Operational margin stood at 12.8%, lower than the expected 14.4%, with EPS at $0.68 compared to the expected $0.80. Global revenue growth is pegged at low-single digits, compared with the previous guidance for a 7% to 10% gain. The retailer also forecasts global comparable store sales to be flat to down by low-single digits, compared with prior expectations for 4% to 6% growth. The company’s long-term growth depends on several sales drivers and correcting some recent actions, as well as implementing cost efficiency measures according to analysts. Looking at a candlestick chart over the last five years using weekly time periods, we can see SBUX gap down significantly on the earnings miss yesterday marking the largest one week drop in this time frame. This has continued its recent trend downwards from its all-time highs from July of 2021 and its recent one year high from May of 2023. We could see support just below the $70 level based on previous lows from the spring of 2022 and past moves.

Past performance is not indicative of future results

Starbucks Corp (SBUX) is currently in a column of 17 O’s in a 2% Point and Figure chart which represents around a 35% drawdown while filtering out the short term noise. To the downside, support can now be found at around $70 and below this at $65.85 which corresponds to the lows from 2022 and the summer of 2020.

3/

Point and Figure Chart

Resistance can be found above at $81.88 should a reversal happen. Further support can be found at around $90. With a bearish SMAX score (which is a near-term 1 to 90-day indicator comparing an asset against different equal-weight asset classes) of 0 out of 10, SBUX is still exhibiting short-term weakness against all asset classes.

Past performance is not indicative of future results

Originally posted 3rd May 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.