Stocks reacted poorly in early trading to several corporate earnings reports that depicted a weaker consumer. At the 9:30 am bell, however, bullish traders quickly erased most of the morning losses, which generated upside momentum. Meanwhile, a light calendar of economic data releases this week has been met with a long list of Fed speakers. Some policymakers are content with existing monetary policy while others see significant inflation risks. In the international arena, the US-Israel relationship showed additional strain with President Biden withholding weapons from Israel amidst an escalation in Middle East tensions.

Fed Speakers Share Views on Rate Cuts

Recent comments from two Fed policymakers argue that the central bank is closing in on rate cuts while a new essay by Minneapolis Fed President Neel Kashkari argues that a rate hike may be appropriate. The following are details from the recent policymakers’ views:

- New York Fed President John Williams on Monday told attendees at the Milken Institute Conference that he anticipates the Fed cutting rates and that monetary policy is currently appropriate for now. The Fed, he maintained, will need to see more encouraging data before beginning to ease.

- Richmond Fed President Thomas Barkin, speaking at the Columbia Rotary Club in South Carolina on the same day, expressed optimism that the existing fed funds rate is sufficient for bringing inflation to the central bank’s 2% target.

- Minneapolis Fed President Neel Kashkari, however, released a paper this week that maintains continued housing inflation and strong demand points to the potential need for a rate hike. Inflation, he wrote, could potentially settle in at a 3% rate. While speaking at the Milken Institute Conference yesterday, he said he needs to see multiple data points illustrating that disinflation is continuing before he would support a rate cut.

Tech Companies Pull Down Equity Markets

A handful of tech companies provided weak second-quarter guidance, causing their share prices to decline significantly, while a boost in advertising revenue supported recent results for Reddit. The following are highlights of recent earnings calls:

- Shopify’s share price dropped approximately 18% after the company provided profit margin guidance for the current quarter that fell below Wall Street expectations. After adjusting for the sale of its logistics business, Shopify expects its gross margin to decline approximately 50 basis points (bps) quarter over quarter. The provider of e-commerce platforms, however, said it anticipates that revenue will climb in the low-to-mid- twenties percentage range year over year (y/y) after accounting for the sale of the logistics business. The disappointing gross margin guidance followed a strong first quarter.

- Intel’s revenue guidance disappointed and caused the company’s share price to drop approximately 9% last night despite first-quarter earnings and revenue exceeding analyst consensus expectations. For the current quarter, Intel anticipates that revenue could reach $13.5 billion while analysts expected $13.79 billion. Strong sales for personal computer, data center and artificial intelligence products resulted in the company’s revenues increasing y/y, while its foundry units experienced a decline in revenue.

- Uber posted a $654 million loss for the first quarter, significantly missing the analyst consensus expectation of $474 million in profit. While its results were hurt by losses in the company’s equity investments in other businesses, it also paid legal settlements, including a Dutch fine for a data breach and a class-action lawsuit involving driver compensation in Australia. Operating income increased but fell short of expectations with Latin America being a weak spot, a result of the timing of Brazil’s carnival and the timing of Easter and other holidays. On an encouraging note, delivery services exceeded expectations with consumers increasingly using the company for groceries and retail purchases. Uber’s share price dropped approximately 9% in early trading.

- Reddit, however, said its revenue climbed 48% from the year-ago quarter with the lion’s share of the increase attributed to advertising. The company generated a large increase in daily users, which helped it attract more advertisers. Reddit’s first-quarter revenue and current-quarter revenue guidance exceeded analyst consensus expectations and the company’s share price jumped 14% in premarket trading this morning. The company’s loss per share narrowed on a y/y basis and exceeded Wall Street expectations.

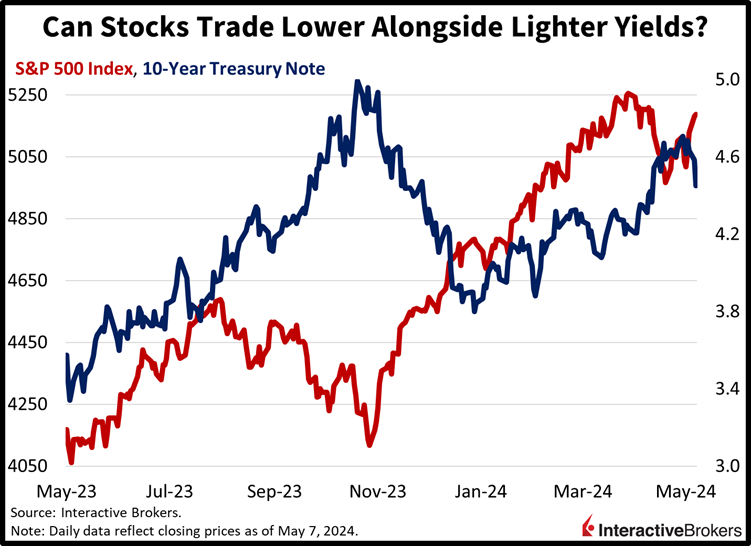

Equities Meander as Yields Climb

Markets are trading with a bearish bias as equities recover off their lows while Treasury yields and the dollar drift modestly higher. The Dow Jones Industrial Average is the only major stock index in the green; it’s up 0.2% while the Russell 2000, S&P 500 and Nasdaq Composite benchmarks are down 0.7%, 0.1% and 0.1%. Seven out of the eleven major sectors are moving south with real estate, consumer discretionary and health care leading the charge lower; they’re down 0.6%, 0.4% and 0.3%. Utilities, energy and communication services are offsetting some of the losses, with the segments higher by 0.7%, 0.3% and 0.3%. In fixed-income land, the 2- and 10-year Treasury maturities are changing hands at 4.83% and 4.49%; the former is unchanged on the session while the latter is up 3 basis points (bps). The dollar is benefiting from loftier long-end rates and demand for safe-haven assets with its index up 13 bps to 105.51. The greenback is appreciating relative to most of its major peers, including the euro, pound sterling, yen, yuan and Aussie and Canadian dollars. It is losing ground versus the franc though. Investors are also scooping up gold to protect against the potential for incremental escalations in the Middle East, with the commodity gaining 0.3%. WTI crude is running a similar path for the same reason as gold while also being supported by lighter inventories stateside; it’s trading higher by 0.8%, or $0.64, to $78.65 per barrel. Meanwhile, copper is down 0.9% on the back of softer manufacturing prospects.

Is This Time Different?

While lower costs of capital helped stocks last year and continue to do so, recent earnings calls point to the potential for lighter yields to signal trouble. The point at which lower interest rates fail to help stocks is likely to coincide with an economic downturn. As equities trade near record highs amidst rates that have drifted lower, the consideration of a worn-out consumer is pivotal. Still, however, since 2022, we’ve seen consumer spending and confidence lose momentum and then pick up again on countless occasions. The following question roaming in our heads after viewing these earnings results is a particularly cautious one as it relates to finance: “is this time different?”

Past performance is not indicative of future results

Visit Traders’ Academy to Learn More About Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.