Originally Posted, 9 April 2024 – Tapping into the nexus of energy transition metals and rare earth miners

Key Takeaways

- Delivering net zero requires a significant step up in investments

- The energy transition is creating a source of structural demand for metals and minerals critical to the transition

- Mining companies involved in the extraction of critical metals and minerals will play a key role in the transition towards net zero by 2050

- Related Products WisdomTree Energy Transition Metals and Rare Earths Miners UCITS ETF – USD Acc

The energy transition is a pathway towards transforming the global energy sector from fossil-based to zero carbon by the second half of this century1. The coming decade will be critical in limiting the impact of global warming.

More than US$200trn investment required by 2050

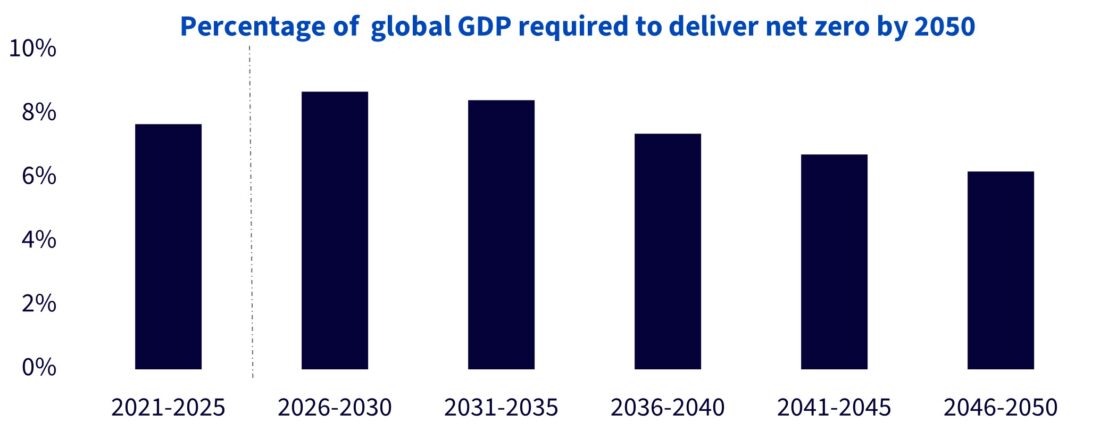

Be it the ‘Fit for 55’ plan in the European Union, The European Green Deal or the US Inflation Reduction Act, governments and commissions expect 25 years of investment in clean energy, electrification of transportation and reductions of non-carbon dioxide climate pollutants to deliver net zero. The higher rate environment has certainly challenged the energy transition infrastructure, technology, and adoption. Yet the need to step up investment to deliver net zero is universal. Forecast costs on the global amount required to deliver the 1.5°C target by 2050 vary from US$200trn to US$275trn2. McKinsey estimates, on average, 7.5% of the global GDP would need to be invested every year for the next 27 years, with a peak in 2026-2031, to achieve net zero by 2050.

Source: Network for Greening the Financial System 2021(Net Zero 2050 scenarios) REMIND-MAg-PIE Model, Vivid Economics, McKinsey Sustainability Insights, WisdomTree as of 16 January 2024. Forecasts are not an indicator of future performance, and any investments are subject to risks and uncertainties.

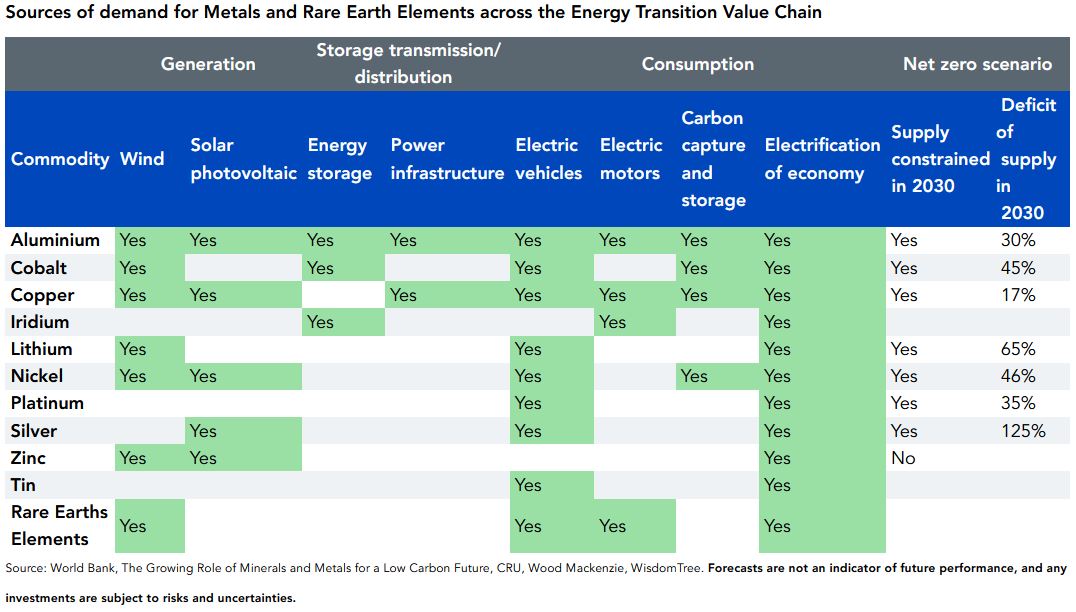

Energy transition bolsters demand for metals and minerals

Metal demand into energy transition-related sectors has soared, and the transition is already driving the fortunes of numerous metals. Over 85% of lithium is now consumed in batteries, up from 45% in 20153. The energy transition is creating a source of structural demand for metals and minerals critical to the transition. In a scenario that meets the Paris Climate Agreement goals (as in the IEA Sustainable Development Scenario [SDS]), the share of clean energy technologies of total demand over the next two decades is expected to rise to over 40% for copper and rare earth elements, 60-70% for nickel and cobalt and almost 90% for lithium2.

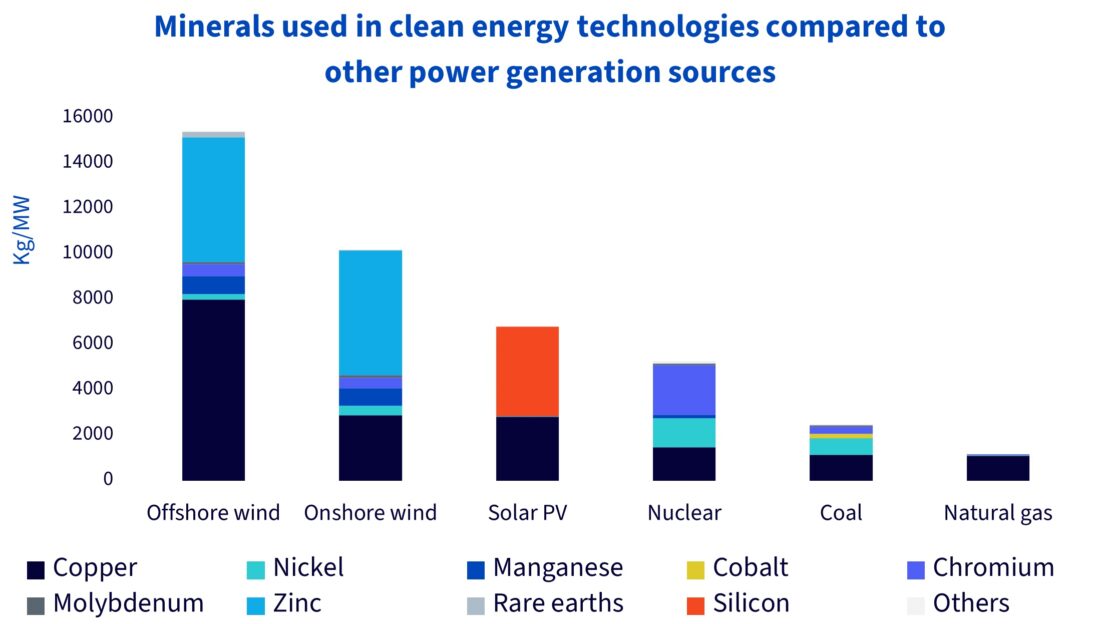

Low-carbon technologies, especially solar photovoltaic, wind and geothermal, are more mineral and metal intensive than fossil fuel technologies. This is because 1 megawatt (MW) of wind or solar energy does not reflect like-for-like replacements for existing natural gas power generation, which remains available on demand. Renewable forms of energy must be supplemented by additional storage infrastructure, which is metal intensive, to smooth out the gaps in energy generation. Since 2010, the average amount of minerals needed for a unit of power generation capacity has increased by 50% as the share of renewables in new investment has increased2.

Source: International Energy Agency, WisdomTree as of 31 December 2023. Historical performance is not an indication of future performance and any investments may go down in value.

Miners are key enablers of the energy transition

Green energy generation, being infrastructure intensive, requires more metals and minerals and, thus, more mining. Enabling clean energy technologies to grow at the pace and scale needed to meet global climate targets, will depend on the rate at which critical minerals can be found and mined. This is why the mining industry will play a focal role in supporting the energy transition.

A report from the think tank, the Energy Transition Commission, warned that mining “will need to expand significantly” to supply enough metals to support the transition. If critical minerals supply is forecast to grow by three and half times by 20304 to meet energy needs, mining will need to expand, but in a sustainable and responsible way. There are supply challenges for many of these metals. Some are hard to find and extract. In some cases, existing mines are mature, making it difficult to grow production, while new mines take time to be operational, thereby creating a risk of supply bottlenecks for certain metals.

Attempting to forecast the timing of the potential recovery in the markets for commodities and mining equities would be unrealistic. For example, nickel, despite its critical importance in lithium-ion batteries for electric vehicles and energy storage systems, experienced high supply growth from Indonesia which resulted in its weak price performance in 2023. However, over the long term, the global nickel market is expected to face a supply deficit by 2030. Herein lies the opportunity for investors prepared to look beyond the short term towards the long-term potential. Mining companies involved in extracting critical metals and minerals are key in the transition towards net zero by 2050.

Source: World Bank, The Growing Role of Minerals and Metals for a Low Carbon Future, CRU, Wood Mackenzie, WisdomTree. Forecasts are not an indicator of future performance, and any investments are subject to risks and uncertainties.

WisdomTree Energy Transition Metals and Rare Earth Miners UCITS ETF (RARE)

Assessment of the criticality of metals and minerals is dynamic and continuously changing, owing to economic, geopolitical and technological factors. WisdomTree has leveraged its leadership in research on commodities and its deep expertise in thematic equities to offer an exciting avenue of growth. We have built on our strong partnership with Wood Mackenzie in the energy transition to identify investment opportunities across the Energy Transition Metals Value Chain (ETMVC).

ETMVC includes the exploration and processing of metals (including rare earth elements) used in technologies associated with the energy transition such as electric vehicles, transmission, charging, energy storage, solar, wind and hydrogen. We aim to provide investors with a solution to investing in the ETMVC via the WisdomTree Energy Transition Metals and Rare Earth Miners UCITS ETF (RARE). The WisdomTree Energy Transition Metals and Rare Earth Miners UCITS ETF seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Energy Transition Metals and Rare Earth Miners Index (the Index).

The Index is designed to identify globally listed companies from developed and emerging markets involved in the ETMVC. Companies that belong to the ETMVC are identified and classified into 11 metal categories (aluminium, cobalt, copper, iridium, lithium, nickel, platinum, silver, tin, zinc, and rare earth elements (REE)) and subsequently up to 22 subsectors (chemicals, conversions, industry, mining, refining, smelting).

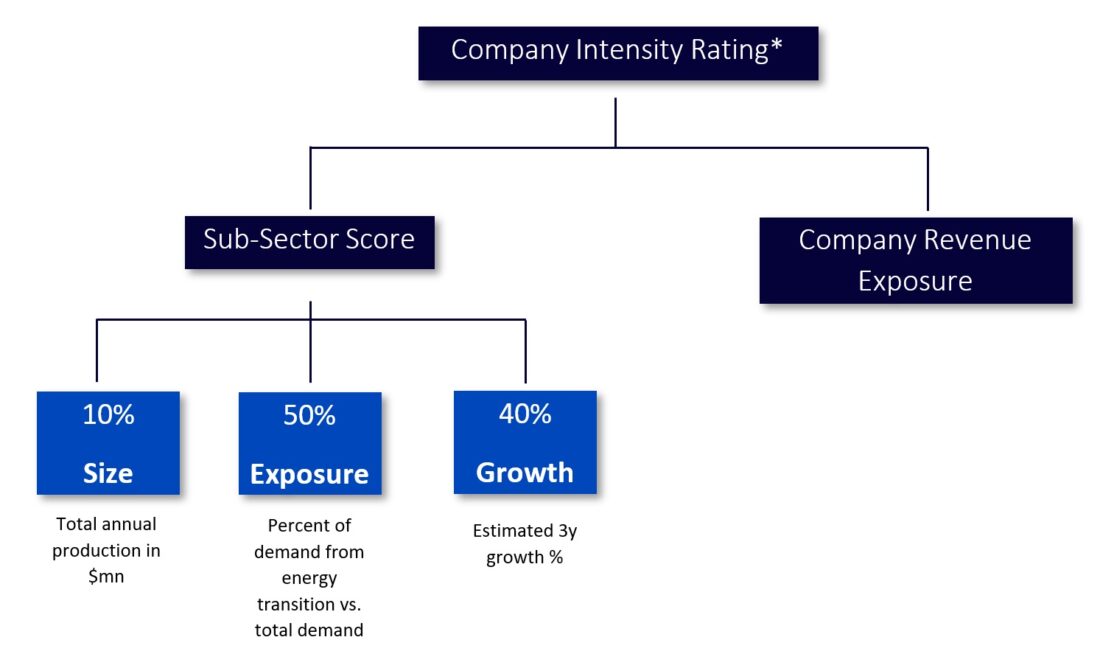

Each energy transition metal has a target weight based on subsector scores, which is a composite measure of the metal’s importance in energy transition, in terms of the metals’ size, exposure and forward-looking demand growth estimates. Each company’s inclusion and weighting in the index depends on its ‘intensity rating’, which is based on each of the metal’s sub-sector scores and the company’s revenue exposure to those metal’s subsectors.

The Index tilts towards pure-play companies that produce the most important metals for the energy transition theme and is rebalanced twice a year. These companies are then subjected to the ESG screening criteria defined within the WisdomTree Environmental, Social and Governance (ESG) framework.

Source: Wood Mackenzie, WisdomTree. *Company Intensity Rating represents a product of the sub-sector scores to which a company is exposed and the company’s share of ETMVC revenue from those sub-sectors.

A closer look at WisdomTree’s Energy Transition Metals and Rare Earth Miners ETF

The portfolio of companies resulting from this process represents a diversified allocation across the ETMVC, titling towards the highest growth metal categories.

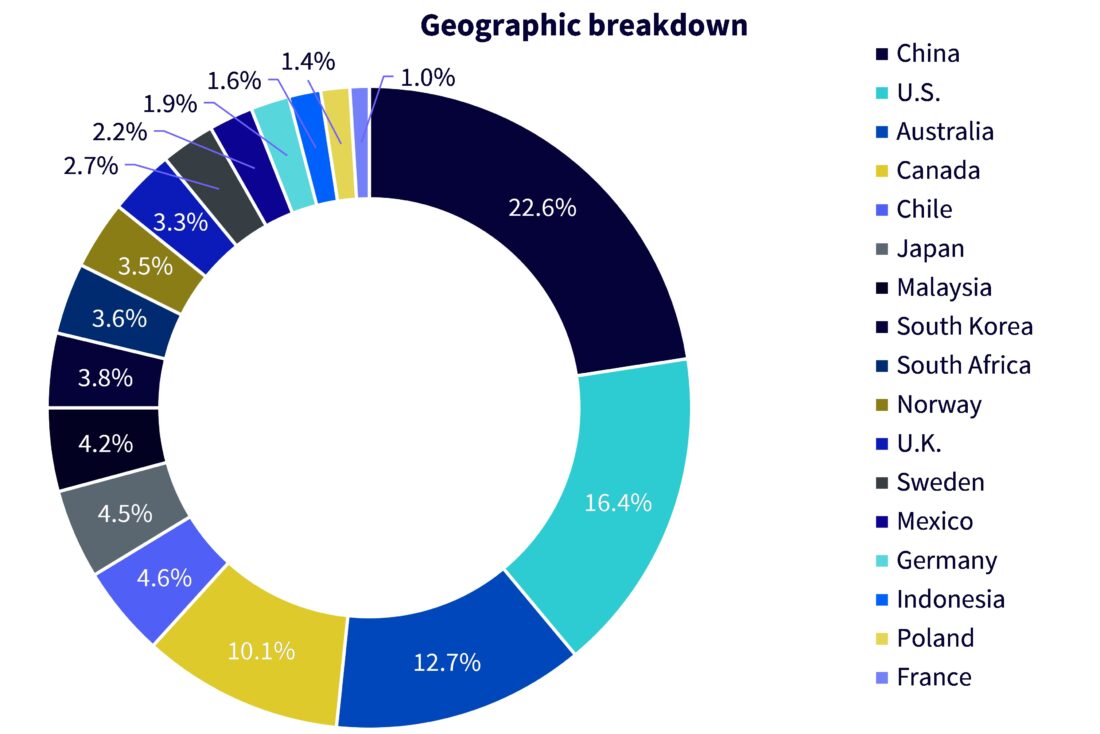

The final selection of companies includes a diverse exposure across sizes, with 53% in midcap stocks, 24% in large cap stocks and 23% in small cap stocks. The revenue exposure of the companies remains geographically diversified across both developed and emerging markets. The table below illustrates the portfolio weighting across geographies.

Source: WisdomTree, Wood Mackenzie, FactSet, Bloomberg as of 31 January 2024

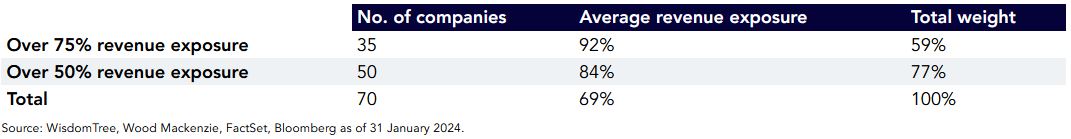

Capitalising on our expertise in the energy transition, close to 60% of the portfolio weight is allocated to companies that have more than 75% revenue exposure to the energy transition metals and rare earth’s theme, highlighting a strong exposure to pure plays.

Source: WisdomTree, Wood Mackenzie, FactSet, Bloomberg as of 31 January 2024.

Conclusion

Amidst the evolving nature of the energy transition, the WisdomTree Energy Transition Metals and Rare Earth Miners UCITS ETF provides a unique equity solution for investors seeking to tap into the nexus of the critical metals and the mining value chain. RARE provides a unique tilt to pure-play mining companies linked to REE, which are often difficult to access owing to liquidity criteria. In addition, the WisdomTree Energy Transition Metals and Rare Earth Miners UCITS ETF also offers access to mining stocks linked to tin and zinc which tend to be overlooked for their role in the energy transition. Undoubtedly, the energy transition is a vast global project and the path to net zero by 2050 will likely be volatile. Our conviction rests firmly on the mining sector serving as a key enabler of the energy transition.

Sources

1 As defined by the International Renewable Energy Agency (IRENA)

2 Network for Greening the Financial System 2021(Net Zero 2050 scenarios) REMIND-MAg-PIE Model, Vivid Economics, McKinsey Sustainability Insights, WisdomTree as of 16 January 2024

3 Source: International Energy Agency (IEA).

4 IEA’s net zero emissions by 2050 scenario.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.