Originally posted 8 January 2024 – Will Suez shipping disruption derail hopes for rate cuts?

David Rees looks at the impact recent disruption to shipping may have on inflation, the outlook for interest rates, and deglobalisation trends.

Growing geopolitical tensions in the Middle East have begun to disrupt global supply chains. Following attacks by Houthi rebels on vessels passing through the Red Sea en route to the Suez Canal and key global economies beyond, major shipping companies have warned of significant delays to deliveries. Satellite images show that virtually no ships destined for major European ports or the US and UK and currently passing through the Red Sea, instead diverting around southern Africa.

Ships destined for major global economies are diverting away from the Red Sea

Source – LSEG, 4 January 2024. Green – Bulkers, Orange/Yellow – Tankers, Blue – Containers, Pink – Other Vessels

The latest disruption follows problems at the Panama canal, where a combination of drought associated with climate change and shifts in rainfall due to El Nino, have caused water levels to fall. Meanwhile in Europe wet weather means that the level of the Rhine, a key shipping route for German manufacturers, is too high. And with the upcoming elections in Taiwan presenting a risk of a repeat of Chinese military drills that disrupted Asian shipping routes in 2022, it seems that global supply chains face a perfect storm of risks.

All of this evokes painful memories of the supply chain problems that erupted during the Covid-19 pandemic. These contributed to the recent bout of high inflation that ultimately forced global central banks to aggressively raise interest rates. Markets are now pricing in aggressive interest rate cuts in Europe, the UK and US, with some cuts anticipated as early as the first half of 2024.

All of this begs the question of whether renewed supply chain problems are about to drive up inflation, forcing policymakers to reassess their outlooks.

Much will depend on how long the current disruptions last, but at least three important differences in the global economic backdrop suggest that problems in the Red Sea are unlikely to lead to major increase in inflation.

First, demand conditions are now much softer. Whereas large monetary and fiscal stimulus fired up the global economy following the initial disruption caused by the global pandemic, growth is now slowing. We project global GDP growth of just 2.5% both this year and next. The eurozone is probably already in recession, the UK is weak and activity in the US is cooling.

Second, whereas lockdowns to contain the spread of Covid-19 meant that demand was concentrated into the goods sector during the pandemic, consumption patterns are now much more balanced. Indeed, the reopening of economies caused demand to skew back towards services over the past couple of years, leaving the global manufacturing sector in recession.

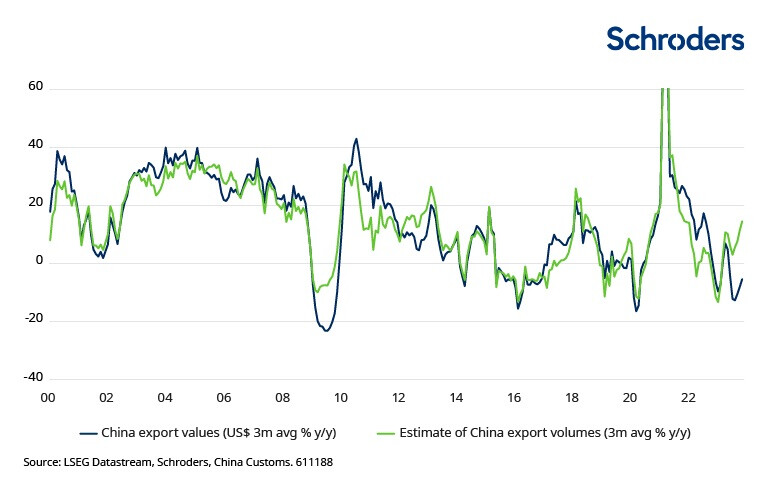

Third, the supply side of the global economy is also in much better shape. Whereas rolling lockdowns completely closed production during the pandemic, there are no such disruptions now. Detours around southern Africa will lengthen delivery times, but goods will still arrive at their destinations – suggesting that outright shortages are unlikely. If anything, recent trade data from China showing exports growing far more quickly in volume than in value-terms, suggest that firms in at least some sectors are having to discount prices to clear excess capacity.

Demand for goods is soft, while there is plenty of supply

Past performance is not indicative of future results

Risks to commodity supplies

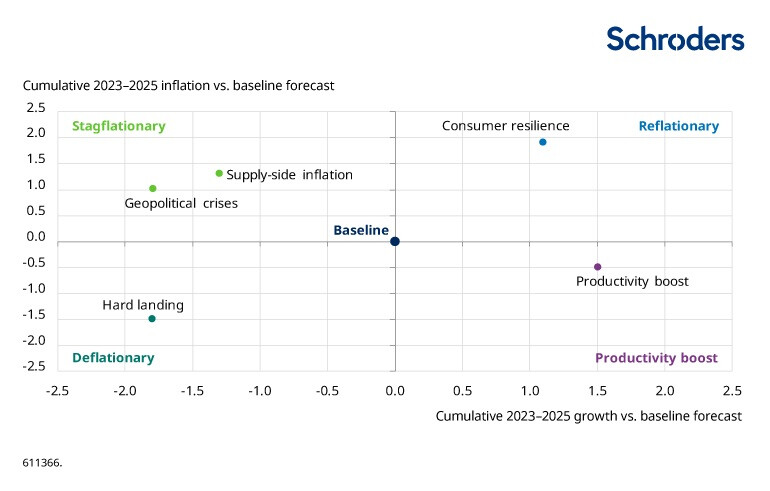

A more immediate risk to global inflation would be if tensions in the Middle East begin to affect the supply of commodities, in particular driving up energy prices. This is something that we began tracking in our latest forecast round with our Geopolitical Crises that assumes, in addition to trade frictions, a broadening of tension in the region causes oil prices to climb towards $120 per barrel. Our simulation moved the global economy in a stagflationary direction as higher energy costs drive up inflation, with the risk of secondary effects (given tight labour markets) weighing on growth and forcing central banks to abandon rate cuts and perhaps even hike further.

So far, though, oil prices have been well-behaved with Brent crude largely unchanged at just under $80 per barrel.

A spike in oil prices would push the global economy in a stagflationary direction

Past performance is not indicative of future results

At the very least, though, the latest hiccup in shipping routes serves as yet another reminder of the risks that stem from relying on lengthy supply chains in a more fractious world. As a result, the rewiring of global supply chains that forms a key pillar of the 3D reset looks set to continue.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.