Originally Posted – 17 April 2024 – Unconstrained fixed income views: April 2024

Has summer heat arrived early for US inflation? With global growth on a surer footing, we ask whether the recent flurry of US inflation surprises is proving to be a ‘game changer’ or ‘a bump in the road’.

The Global Unconstrained Fixed Income team assesses the current macroeconomic environment, and where it might be heading by looking at the likelihood of various possible states of the world.

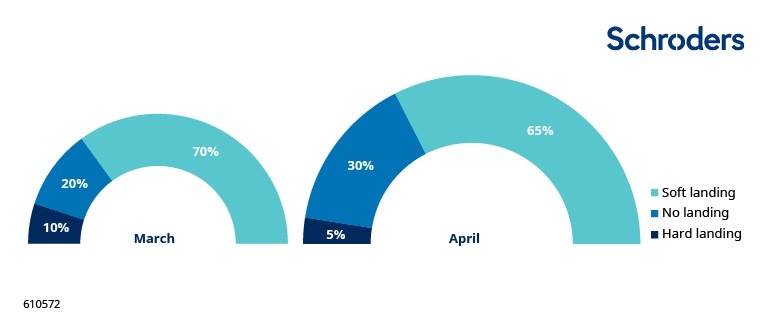

Our base case anticipates a soft landing. However, we recognize increased risks of a ‘no landing’ scenario due to a series of US inflation surprises and a potential upturn in the global manufacturing cycle, which could bolster commodity prices. This situation might compel central banks to maintain higher interest rates for an extended period to combat persistent inflation.

Probability of ‘no landing’ rises as robust growth increases inflation risks.

Past performance is not indicative of future results

Source: Schroders Global Unconstrained Fixed Income team, 15 April 2024. For illustrative purposes only. “Soft landing” refers to a scenario where economic growth slows and inflation pressures eases; “hard landing” refers to a sharp fall in economic activity and additional rate cuts are deemed necessary; “no landing” refers to a scenario in which inflation remains sticky and interest rates may be required to be kept higher for longer.

US inflation surprises – a game changer or a bump in the road?

In short, we see the latest news of robust US inflation as somewhere in between the two. A string of upside beats does not rule out rate cuts later this year, but it certainly will create reason for the US Federal Reserve (Fed) to pause for thought, with a cut in June now looking like a relatively unlikely probability.

Looking at Fed Chair Jerome Powell’s preferred measure for inflation (that’s core services excluding shelter) the trend in the previous couple of months has been a little concerning. Having risen 0.7% month-on-month in the latest release, this “super core” measure of inflation is now running above 8% on three-month annualised basis. Looking at a broad range of measures, the reality is that inflation is currently running too hot for the Fed to feel comfortable easing monetary policy conditions in the near term.

But it’s not all bad news on the inflation front in the US. As fixed income investors we believe there are more reasons for optimism when looking at the labour market. On several measures the labour market looks like it is returning to balance with wage growth trending lower, vacancies declining gradually and – most importantly – the rate at which workers are quitting their jobs continues to move down. Quit rates are a leading indicator for wage growth, with a declining rate limiting how fast wages rise, as companies are less pressured to keep and attract workers.

The global cycle improves, pointing to a soft landing but with some inflation risk…

There has been continued improvement in global manufacturing over the month. News out of China has been particularly positive lately, something which is likely to disproportionately benefit eurozone growth in the months ahead. While all of this is encouraging for a ‘soft landing’ outcome, we stay alert to the potential that rising commodity prices feed into inflation pressures going forward as this would further challenge the thesis of rate cuts this year.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.