Originally Posted, 22 March 2024 – What’s hot: Central Banks – East raising and West cutting… China dithering

Key Takeaways

- That last mile of inflation is causing more divergence across central banks globally.

- The BOJ embarked on a significant yet incremental step, exiting negative interest policy for the first time in 17 years.

- Japanese equities are likely to benefit from structural opportunities that may emerge from its exit from deflation.

- Related Products WisdomTree Japan Equity UCITS ETF – USD Hedged, WisdomTree Japan Equity UCITS ETF – GBP Hedged, WisdomTree Japan Equity UCITS ETF – JPY Acc, WisdomTree Japan Equity UCITS ETF – EUR Hedged Acc, WisdomTree Japan Equity UCITS ETF – USD Hedged Acc, WisdomTree Short JPY Long USD 3x Daily, WisdomTree Short JPY Long EUR 3x Daily

This was a mammoth week for central bank policy decisions. On the one hand the Bank of Japan (BOJ) finally put an end to the world’s last negative rate regime, Taiwan’s central bank surprised markets by raising its policy rate by 12.5Bps while the Swiss National Bank (SNB) surprised markets with a 25Bps rate cut.

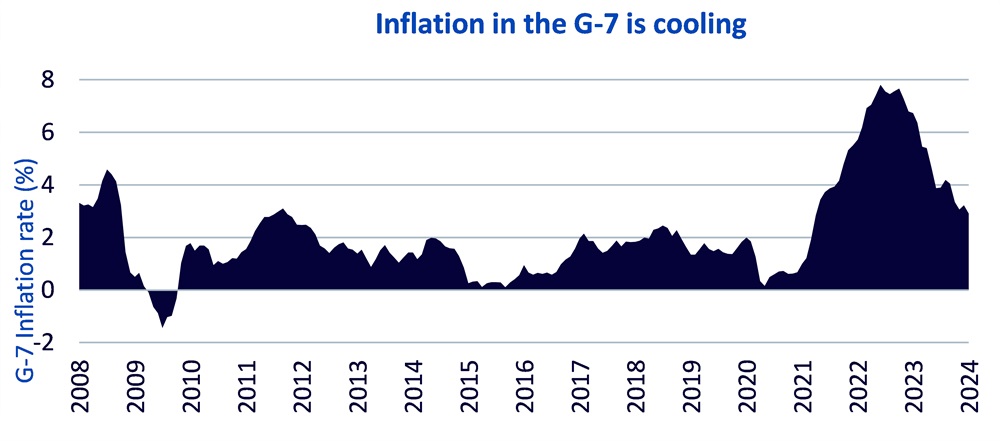

That last mile of inflation is causing more divergence across central banks globally with central banks in the east raising rates, the west embarking on rate cuts while China remains on the sidelines owing to concerns of a weaker Renminbi. There was no policy change from the Federal Reserve (Fed) with the target rate left at 5.25%-5.5%. The Fed updated their forecasts for showing significant upward revisions to growth but almost no change to unemployment and inflation, keeping the disinflationary trend in place. The Reserve Bank of Australia and the Bank of England kept rates on hold as broadly expected.

Source: Organisation for Economic Cooperation & Development, WisdomTree as of 21 March 2024. The G-7 includes – Canada, France, Germany, Italy, Japan, United Kingdom, and United States. Historical performance is not an indication of future performance and any investments may go down in value.

BOJ ends the world’s last negative rate regime

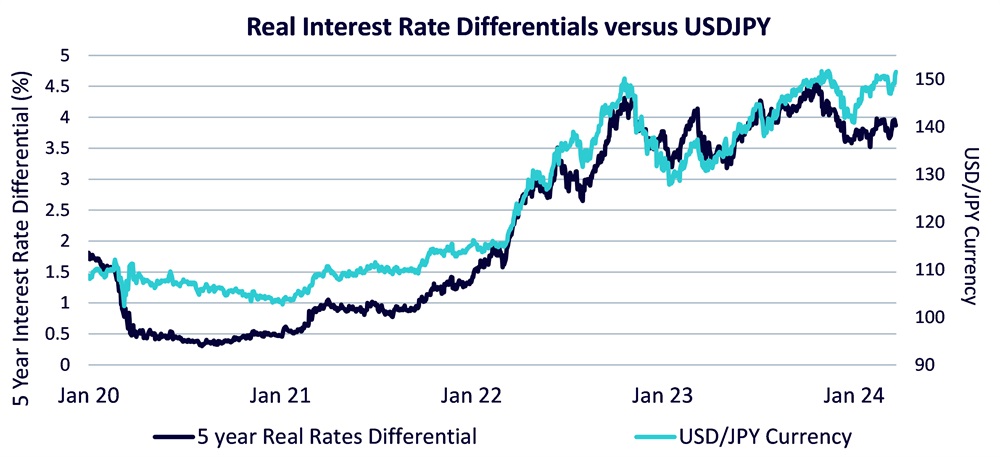

The BOJ embarked on a significant yet incremental step, exiting negative interest policy for the first time in 17 years. Yet the market seemed to take this bold step in its stride. Neither the yen nor the Nikkei 225 Index displayed abrupt movements, and the Japanese government bonds (JGB) 10-year yields remained contained below 80Bps1. This is partly because the communication from the BOJ leaned on the dovish side as signalled by Governor Ueda, “it is necessary to maintain accommodative financial conditions”. It’s important to consider that shifting from negative to 0-10Bps overnight rates allows the BOJ to return to operating policy via short term rates instead of a set of unconventional policy tools and that these rates remain accommodative.

BOJ’s policy normalisation came on the heels of the Shunto wage negotiations that agreed on a bumper wage hike by 5.28% for 20242. The results of the spring wage negotiations suggest that real wage growth will turn positive, and if inflation stabilises around BOJ target of 2% it should support the 2025 Shunto salary increase. The BOJ remains in wait-and-see mode, particularly given the economic uncertainty coming not only from Japan but also from the global economy. Japan’s economic growth is projected to continue moderately however slowing economic growth overseas could remain a potential drag. For now, the BOJ appears reluctant to signal further policy tightening and is likely to take a gradual approach to raising rates. This coupled with the Fed continuing to expect three cuts this year, should keep yen appreciation limited.

Source: Bloomberg, WisdomTree as of 21 March 2024. Historical performance is not an indication of future performance and any investments may go down in value.

Japanese equities outlook remains positive amidst a gradual rate tightening cycle

The inflationary environment continues to support corporate reforms. In 2023, the Tokyo Stock Exchange’s (TSE) corporate governance reform agenda focused on improving listed companies Price to Book (P/B) ratio, garnered a lot of attention. This was evident from the subsequent rise in payout ratio’s by listed companies. Share buyback programs established in F3/24 (April 2023 through to March 2024) by companies listed on the TSE prime market totalled 9.4Trn3, setting an all-time high. Should payout ratios continue to rise it should encourage inflows of funds into the revamped Nippon Individual Savings Account (NISA) as discussed here. With the launch of the new NISA program in 2024, the market has seen a preference for high dividend Japanese stocks.

TINA is alive in Japan

There is no alternative (TINA) but equities, the famous acronym over the past decade of lower interest rates, still remains intact in Japan. Equity risk premiums in Japan remain comparatively high at 2.86% versus -0.15% for US equity markets. After attaining a 34-year high4, the prospect of Japanese equities remains promising owing to strong earnings growth. Japanese equities ended Q3 F3/24 with a 20% YoY increase in pre-tax profits5. Additionally, Japan has the highest 3-month earnings revision ratio globally.

Source: BofA, iQDatabase, WisdomTree, as of 21 March 2024. Historical performance is not an indication of future performance and any investments may go down in value.

We expect rising wage growth and higher inflation, to support a recovery in consumer demand. In addition, Japan’s manufacturing and technology sectors stand to benefit from the growing structural demand for corporate spending on AI technologies and automation as they address demographic challenges.

Sources

1 Bloomberg as of 19 March 2024

2 Reuters as of 15 March 2024

3 Bloomberg, Factset as of 14 February 2024

4 Bloomberg as of 21 February 2024

5 Earnings results of MSCI Japan for the July – September quarter, Bloomberg as of 31 November 2023

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.