Originally Posted, 12 April 2024 – What’s Hot: Industrial metals rebound as supply restraint starts to kick in

Key Takeaways

- The base metals market is demonstrating that the cure for low prices is low prices.

- Supply constraint following heavy losses in industrial metals is tightening the market and helping to generate a rebound.

- Tentative signs of China’s demand firming have also helped prices.

- Related Products WisdomTree Industrial Metals, WisdomTree Industrial Metals Enhanced, WisdomTree Copper, WisdomTree Nickel

The Bloomberg Commodity Industrial Metals Index has risen 6.9% in April 2024 so far (28/03/2024 – 11/04/2024) following a decline in the first quarter of this year. Could this be a turn in the industrial metals cycle?

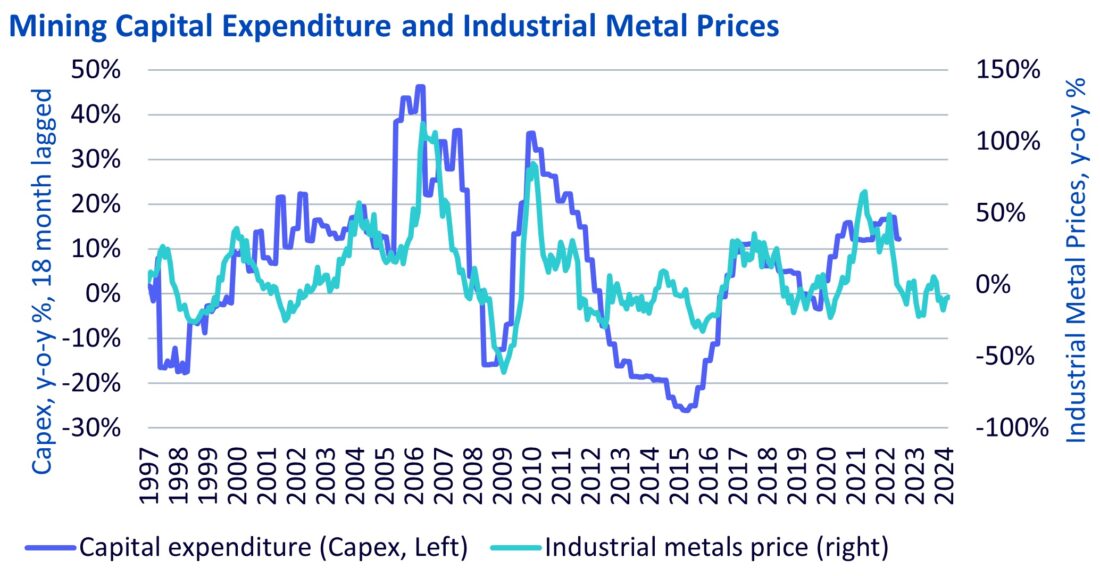

There is an adage that the cure for low prices is low prices. We are seeing that play out in industrial metals. With industrial metal prices having suffered through most of 2023, supply restraint from miners and smelters has become the response and as a result, industrial metal prices have started to regain some lost ground. As the chart below shows, capital expenditure tends to lag industrial metal prices. Up until recently, capital expenditure in mining activity was accelerating, but in the last quarter we saw a deceleration (albeit still positive year-on-year growth). That deceleration in capex, combined with other signs of supply restraint could mark the turning of the industrial metals price cycle.

Source: WisdomTree, Bloomberg, February 1997 to March 2024. Historical performance is not an indication of future performance and any investments may go down in value.

Nickel projects mothballed

In January, First Quantum Minerals Ltd announced that it would suspend nickel mining at Ravensthorpe and only process stockpiles. Panoramic Resources Ltd also announced that it would suspend its nickel mining operations at its Savannah mine. Then mining giant BHP announced plans to shut down its Nickel West operations. All these projects are in Australia.

However, the main source of oversupply is from China and Indonesia in low quality nickel suitable for Nickel-Pig-Iron (NPI). We believe nickel output could be cut by 100,000 metric tons this year as producers seek to limit losses following a slump in the price of the metal.

Koniambo Nickel SAS (KNS) – a joint venture between Société Minière du Sud Pacifique SA (SMSP) and another mining giant Glencore plc –made the decision to transition KNS into care and maintenance in February 2024. Even with the French government’s proposed assistance, high operating costs and weak nickel market conditions would have meant that KNS would be an unprofitable operation.

Coordinated copper smelting restraint

In March, China’s top copper smelters agreed to jointly embark on production cuts at some loss-making plants as they seek to cope with a shortage of raw material. That exemplifies the juxtaposition between tight raw material availability and weak prices – a situation hard to maintain.

Chinese smelters had been rapidly expanding their capacity over the past year to get ahead of an expected surge in copper demand from sectors related to the green energy transition such as electric vehicles or wind and solar energy. But several mine disruptions globally, including the shutdown of the big Cobre mine in Panama owned by First Quantum, have meant copper concentrate is now in short supply.

Demand not as bleak as feared?

Industrial metal prices opened the year weighed by ongoing concerns around the Chinese economy. The new GDP growth targets set in early March 2024 for China were initially met with scepticism as they were not supported by a new bout of stimulus. However, Chinese Manufacturing Purchasing Managers Indices appear to be rebounding (with the latest reading above the crucial 50 demarcation between contraction and expansion).

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.