Originally posted, 26 April 2024 – What’s Hot: Is oil sufficiently pricing in geopolitical risks?

Key Takeaways

- While Iran’s total oil production could be replaced by OPEC’s spare capacity….

- … the volume of oil transit through the Strait of Hormuz will be hard to replace.

- With other chokepoints already compromised by the war, oil markets are vulnerable to price spikes.

- Related Products WisdomTree WTI Crude Oil, WisdomTree Brent Crude Oil, WisdomTree Energy Enhanced

The Middle East War has stepped up a gear

Israel has responded to Iran’s attack of 13th April with a largely symbolic strike. While Iran sent 300 missiles and drones into Israel in a very public display, the details of Israel’s 19th April counterattack remain limited. Israel, while conducting the counterattack appears to have tried to appease United States and its other allies by not overly escalating the situation. Oil markets largely shrugged off the latest events. Although Brent prices initially gained more than $3 per barrel to above $90 per barrel intraday on 19th April, they ended the day trading slightly below the previous day. However, such matters are finely balanced and tipping back into a more aggressive stance could be just moments away.

The conflict has clearly shifted gears: there is now an overt war between Israel and Iran, where previously Iran had been using its proxies – Hamas, Houthis, Hezbollah – to do its bidding. This elevates the risk for the oil markets, through a combination of potential supplies from Iran being disrupted and more importantly because of Iran’s geographical position near the world most important choke point.

Iran is an important producer but can be compensated by OPEC spare capacity

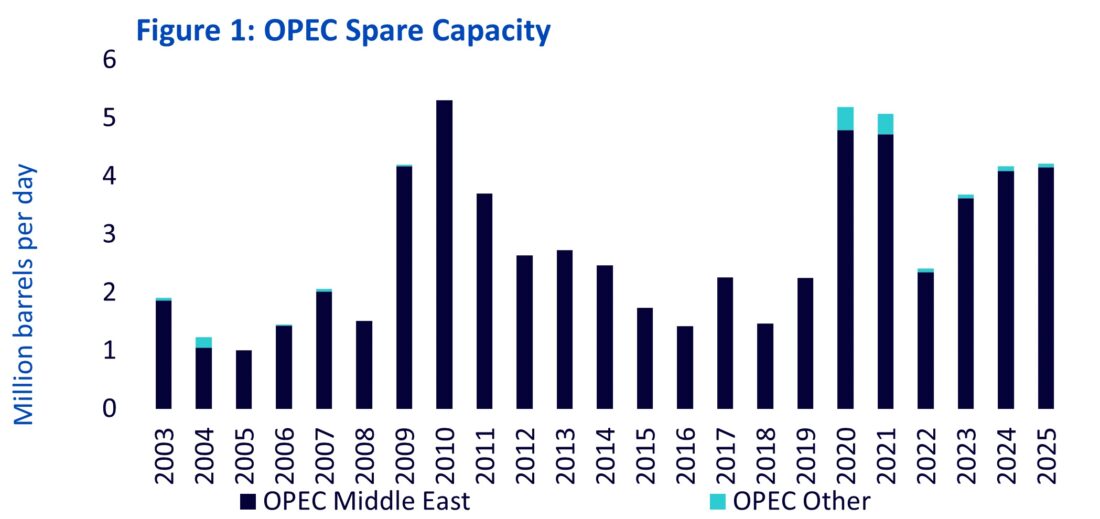

Iran’s oil production is 3.25 million b/d (Source: Internation Energy Agency, April 2024). Should there be disruption to its oil supply, we believe that the rest of the Organization of the Petroleum Exporting Countries (OPEC) could compensate for loss of production, as the group has more than 4 million b/d effective spare capacity (Source: Energy Information Administration of USA, April 2024). There may be some delay in turning all the production on though. But more importantly potential disruptions to oil transit choke points complicate matters.

Source: Energy Information Administration of USA, April 2024. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

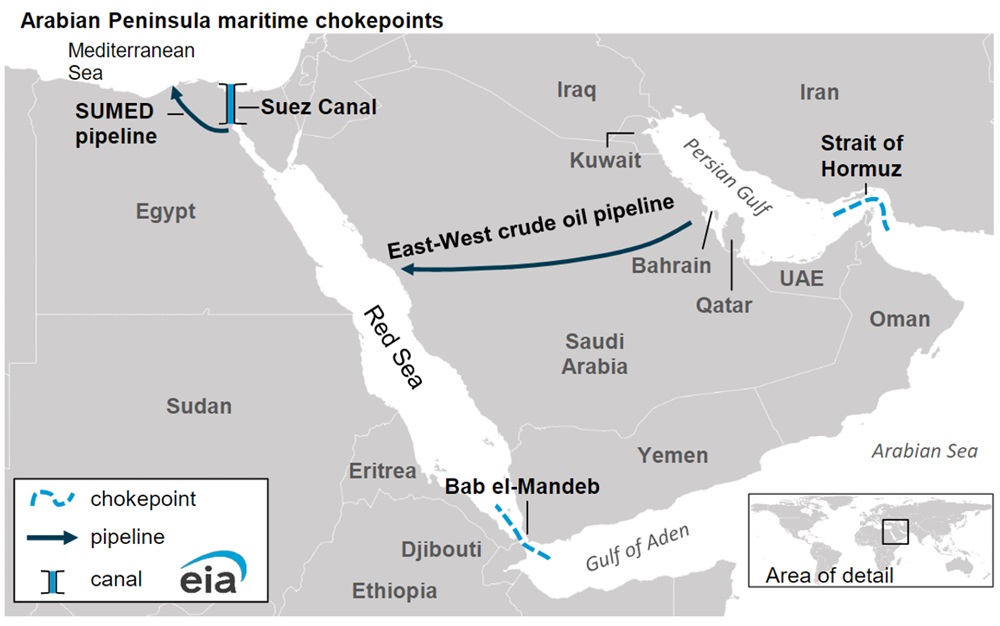

The Strait of Hormuz: the most important choke point

The Strait of Hormuz, located between Oman and Iran, connects the Persian Gulf with the Gulf of Oman and the Arabian Sea. The Strait of Hormuz is the world’s most important oil chokepoint because large volumes of oil flow through the strait. In 2022, its oil flow averaged 21 million barrels per day (b/d), or the equivalent of about 21% of global petroleum liquids consumption or more than a quarter of all maritime oil trade. We estimate a similar amount for 2023.

It is also an important transit route for liquefied natural gas (LNG) with 10.9 billion cubic feet per day moving through the Strait of Hormuz. That is approximately a fifth of global LNG.

Figure 2

Source: Energy Information Administration of USA, 2023

The Bab el-Mandeb Strait and Suez Canal: already compromised

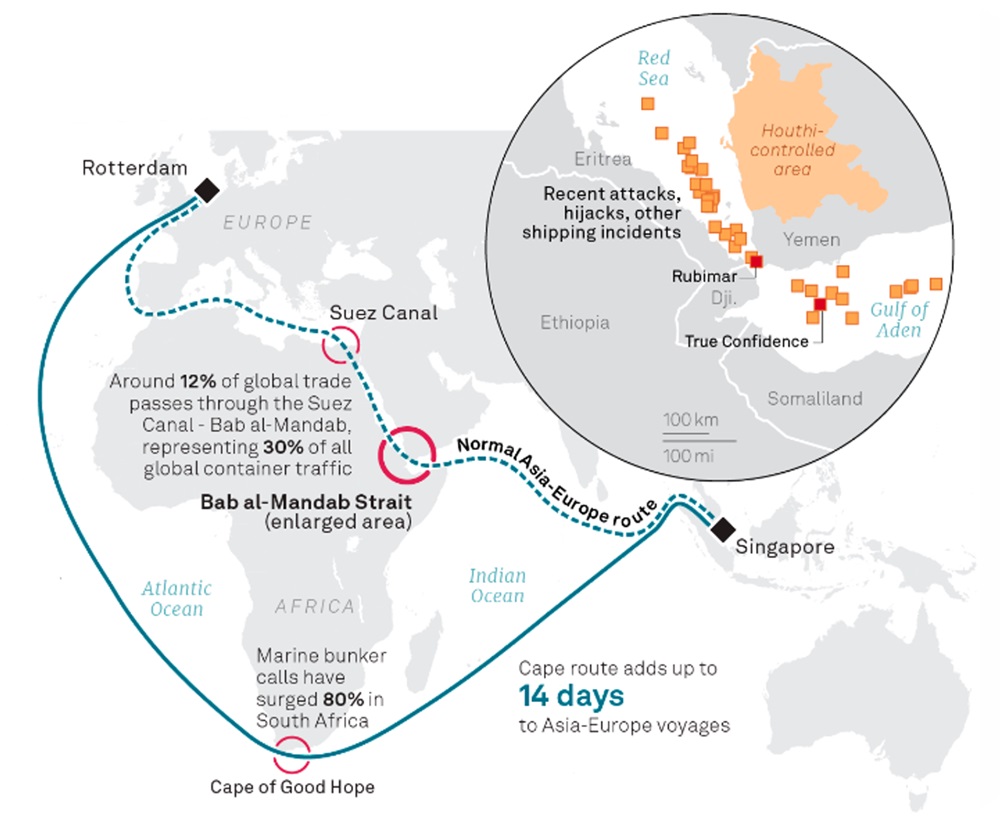

The Israeli war has already created large disruptions to oil flow through the Bab el-Mandeb Strait, which in 2022 accounted for 7.1 million b/d of transit. That is close to a third of the maritime oil volume that goes through the Strait of Hormuz. The attacks on ships in the Red Sea by Houthi rebels has driven many tankers to take a 4000-mile detour around the Cape of Good hope in South Africa, which adds an extra 14 days to the Europe-Asia trade route. That adds significant costs to deliveries and tightens supply oil.

The Suez Canal, another important choke point around the Red Sea is also disrupted due to the ongoing conflict.

Figure 3: Circumventing the Arabian Peninsula via the Cape of Good Hope takes many more nautical miles

Source: S&P Global, 2024

Figure 4: Oil choke points in the Middle East by the numbers

| Million barrels per day | 2022 |

| Oil flow through Strait of Hormuz | 20.8 |

| Oil flow through Bab el-Mandeb Strait | 7.1 |

| Oil flow through Suez Canal and SUMED pipeline | 7.2 |

| World maritime oil trade | 75.2 |

| World oil consumption (all liquids) | 99.6 |

| Billion cubic feet per day | 2022 |

| LNG flow though Strait of Hormuz | 10.9 |

| LNG flow through Bab el-Mandeb Strait | 4.5 |

| LNG flow through Suez Canal | 4.5 |

Source: Energy Information Administration of USA, 2023. Historical performance is not an indication of future performance and any investments may go down in value

How disruptions could occur

Disruption to oil moving through the Strait of Hormuz could come in a number of ways:

- Collateral damage from missiles

- Iran could block the Strait in an act of protest

In 2019, Iran conducted a number of attacks on ships around the Strait of Hormuz. Iran’s Revolutionary Guards also captured a British-flagged oil tanker in the Gulf after Britain seized an Iranian vessel for violation of sanctions.

Iran’s oil production similarly could be affected in a number of ways:

- Collateral damage from missiles

- Sanctions against Iran tightened

Sanctions and more sanctions

In recent years, Iran has expanded production because the US has not enforced its extraterritorial sanctions on Iran with as much vigour as in previous years. To be clear, the US does not import any Iranian oil and has not done since the 1970s. But its sanctions apply globally – any entity importing Iranian oil will violate US sanctions. The US loosened its enforcement because it wanted to advance discussions on a nuclear deal. The recent escalation of the conflict will increase pressure on the US to revert to tighten enforcement. Whether the US will follow through is unclear given it has reimposed sanctions targeting Venezuela’s oil exports and energy sector investments on 17 April 2024, and set a deadline of 31 May for most foreign companies to wind down business with state-owned oil firm PdV. With multiple sanctions to enforce, upward price pressure on oil in an election year and less chances of reprieve from interest rate cuts, the Administration may shy away from being as hawkish as it could be.

Geopolitical risks fairly priced?

With Brent oil falling below $90/bbl, we are unconvinced that that the markets are pricing in all the geopolitical risk that is present today. The market maybe putting a lot of faith in the ability of OPEC to react to potential disruptions and the market maybe hopeful that the tensions de-escalate or the sanction enforcement remains slack.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.