Originally posted – 19 Feb 2024 – Who wins if Toyota’s bet on solid-state batteries pays off?

Toyota made headlines recently with its claims of being on the cusp of manufacturing solid-state batteries at scale – a technology that could prove to be a gamechanger for Electric Vehicles (EVs). If successful, Toyota’s solid-state batteries could give electric vehicles a range of 1,200km – more than twice the range of most battery-powered vehicles – and a charging time of 10 minutes or less.

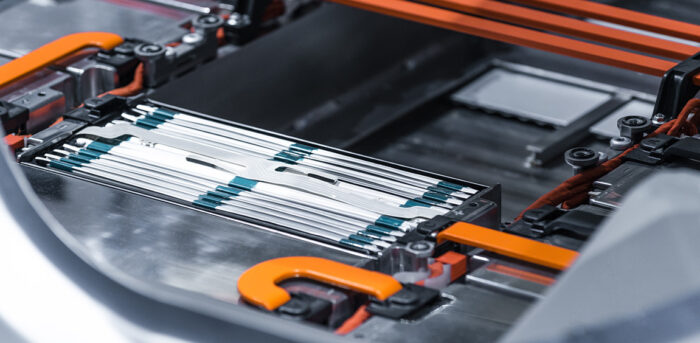

A solid-state battery replaces the liquid electrolyte in a lithium-ion battery with a solid electrolyte. The resulting battery can achieve much greater energy density and improves safety by reducing the risk of explosion or fire. And, due to its higher energy density and less need for safety components, the battery can be made much smaller in size, thereby making it ideal for road transportation.

So, if solid-state powered cars hit the market as soon as 2027 or 2028, as claimed by Toyota, and the technology is as groundbreaking as it promises to be, who might be the winners from all of this?

Source: dw.com, 2023. https://www.dw.com/en/what-you-need-to-know-about-solid-state-batteries/a-66695582

Consumers

Range anxiety is still one of the main hurdles for EV adoption. A recent survey conducted by Recurrent revealed that 76% of prospective EV owners worry about range, although this drops to around 59% of current owners1. Improved range and reduced charging time will certainly help alleviate concerns for many prospective adopters of EVs.

Raw materials

There is an overlap between the set of materials used in a solid-state battery and those used in lithium-ion batteries. Producers of key raw materials like lithium and manganese, among others, will benefit from the wider adoption of the technology.

Automakers

At the start of last year, we joined the chorus of voices criticising Toyota for its lack of strategy on electric vehicles. Worldwide sales of plug-in EVs hit 1.3 million in October 2023, with Chinese automakers dominating the top 20 most sold models2. Toyota, one of the largest automakers in the world, is nowhere to be seen on such lists – despite it being one of the first to enter the space for self-charging hybrid cars.

But a change in leadership over the course of the year likely catalysed a renewed push towards doing something special to redeem its reputation as a leading automaker. And although some of it may be attributable to a more favourable macro backdrop (yen depreciation) for Japanese exporters, Toyota’s share price trajectory in 2023, particularly in the second half of the year, suggests markets started seeing the company more favourably following its solid-state headlines.

But the benefits of the technology will accrue to any automaker that makes its own breakthrough with the technology. In October last year, Chinese automaker, Nio, made a filing with the Chinese government to add solid-state batteries to 11 more of its models, after previously filing to include it in 3. Clearly, other automakers are taking note of the technology and are keen to participate.

Emerging technologies

The innovation could propel other technologies as well. One obvious example is battery swapping. If you ask an operator of electric buses why battery swapping is not used widely to reduce the time it takes to get the bus back on the road once its charge is depleted, they will cite how impractical it is to do so given the size of the battery. A smaller battery, which could potentially have a modular structure, could facilitate battery swapping – something that could be especially beneficial for use in commercial vehicles.

Battery swapping can also reduce the upfront cost of purchasing electric vehicles, be it passenger cars or larger commercial vehicles. If buyers own the vehicle – except the battery – and subscribe to a battery service, not only will the ownership costs come down, but so will the concerns around the life of the battery.

Investors

The beauty of thematic investing is that by casting the net wide across a sea of possibilities, investors give themselves the chance of making a big catch. Such is the nature of investing in things that can change the world. Some ideas work, others don’t. But the hope is that the ones that do are enough to make the endeavour worthwhile.

‘Solid-state’ is recognised as one of the 37 subsectors within the WisdomTree Battery Solutions UCITS ETF (VOLT). Our partnership with Wood Mackenzie enables us to reevaluate the attractiveness of any given battery technology on an ongoing basis. At each six-monthly rebalance, all subsectors receive updates to their intensity scores, a measure of the importance of a subsector to the battery theme. By extension, all companies within the battery value chain receive updates to their intensity ratings, a measure of how much revenue the company generates from the given subsector. This approach not only allows investors to capture a wide array of innovations, any of which could become the next big thing, but also ensures that the strategy keeps one eye on the industry as it stands today and another on its future.

A second way for investors to capture the growing excitement in the automotive industry is through the WisdomTree Global Automotive Innovators UCITS ETF (WCAR). The strategy is built in partnership with automotive experts Berylls who evaluate the focus of all companies in the automotive industry on innovation, growth, and sustainability, and LeanVal, who evaluate the fundamentals of each business. At each six-monthly rebalance, the top companies based on this evaluation are selected.

As of January 2024, Toyota features in both strategies.

Sources

1 Reported by CBT News November 2023.

2 Inside EVs, December 2023.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.