As I commented in the article Reflections on the European Equities Market performance in 2023, following 2022, a year in which the most popular topics were rampant inflation and the conflict in Ukraine, in 2023 the main topics tended to be the increase of interest rates and inflation remaining moderate, which caused investors to start talking about when interest rates might start to go lower.

Similar to the equities markets, the fixed income market performed well in the past year, with an upward trend at the beginning of the year, a sharp decline from February to March, followed by a lateral trend until October when a bullish rally began, lasting until the end of the year.

To compare the different categories of fixed income in Europe, it is useful to use the following ETFs:

| Name | ISIN | Symbol | 2023 performance % |

| iShares Core € Govt Bond UCITS ETF | IE00B4WXJJ64 | EUNH | 7.06% |

| iShares Core € Corp Bond UCITS ETF | IE00B3F81R35 | IEAC | 8.04% |

| iShares € High Yield Corp Bond UCITS ETF | IE00B66F4759 | IHYG | 11.33% |

| iShares € Inflation Linked Govt Bond UCITS ETF | IE00B0M62X26 | IBCI | 5.87% |

| iShares € Govt Bond Climate UCITS ETF | IE00BLDGH447 | SECD | 7.22% |

| iShares € Corp Bond ESG UCITS ETF | IE00BYZTVT56 | SUOE | 7.83% |

| iShares € Covered Bond UCITS ETF | IE00B3B8Q275 | IUS6 | 5.45% |

We can see the price movement of these ETFs in this 1 Year Daily Candle Chart:

Source: ibkr.ie Past performance is not indicative of future results.

We can quickly see that it has been a year where the appetite for risk has paid off for the most daring investors. The category with the best performance has undoubtedly been that of High Yield Bonds, chalking up an 11.33% gain. Many investors anticipated a recession, which would have considerably affected this category, as it is the one with the highest credit risk, and therefore most affected by the probability of bankruptcies, but the reality has been very different. Optimism regarding the economy and the return to low inflation has planted the seeds of hope that interest rates may go lower.

On the other hand, categories with the lowest yields have been the more conservative ones with a yield of 5.45% in the Covered Bond and 5.87% in the Inflation Linked Govt Bond.

ESG bonds, a relatively new category and very trendy in recent years, has performed similarly to their traditional counterparts, without a considerable difference in profitability or return.

Spreads between countries

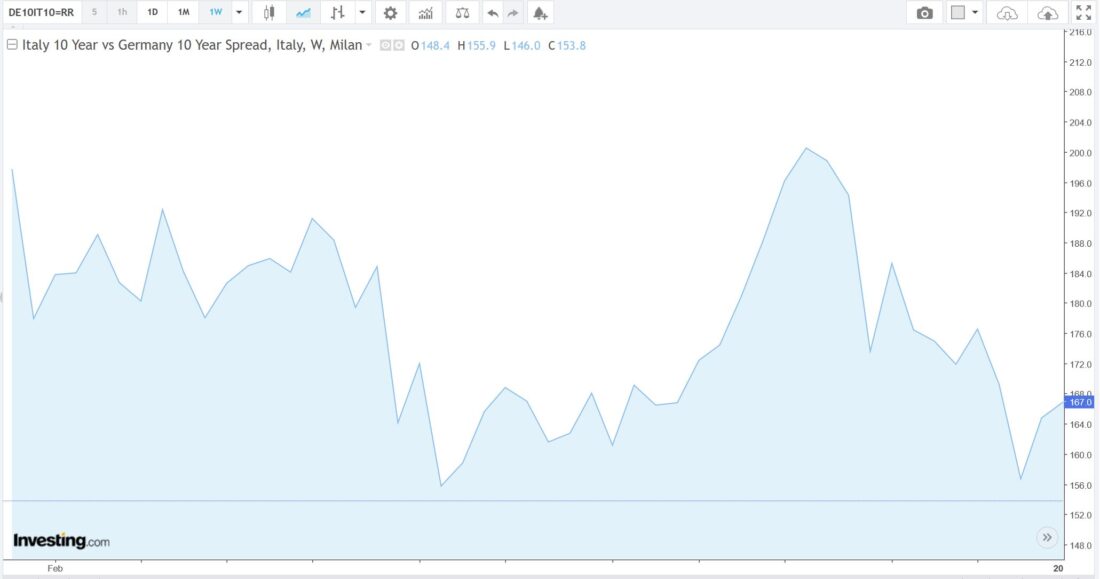

2023 was a year of change for the Eurozone bond market, characterized by widening differences in government bond yields between member states. While all bond yields rose due to the European Central Bank’s (ECB) interest rate hikes, the yields of specific countries increased more during certain periods. This movement, known as “widening spreads,” reflected various factors and had significant implications. Concerns about specific countries’ finances, such as Italy and Greece, caused investors to seek “safer” options, pushing their bond yields higher relative to others. For example, the gap between Italy’s 10-year bond yield and Germany’s (considered a “safe” haven), increased 200 basic point in October, reflecting concerns about its debt levels and political stability.

We can see this spread in the following chart:

Source: Investing.com Past performance is not indicative of future results.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Order Types / TWS

The order types available through Interactive Brokers Trader Workstation are designed to help you limit your loss and/or lock in a profit. Market conditions and other factors may affect execution. In general, orders guarantee a fill or guarantee a price, but not both. In extreme market conditions, an order may either be executed at a different price than anticipated or may not be filled in the marketplace.

Disclosure: Bonds

As with all investments, your capital is at risk.