Factor investing involves selecting securities based on specific characteristics that may explain their similar risk and returns. Common factors include Value, Small cap, Momentum, Low volatility, Dividend yield, Quality, and Growth.

Here’s a breakdown of each factor:

– Value: Stocks considered undervalued or overvalued based on fundamentals like low Price-to-Earnings or Price-to-book ratios.

– Small cap: Stocks with lower market capitalization, often seen as potentially offering higher returns with increased risk.

– Momentum: Stocks that have recently outperformed with high returns, with investors expecting this trend to continue.

– Low Volatility: Stocks with less volatility, potentially offering a better risk-return profile.

– Dividend Yield: Stocks with higher dividend yields compared to the market average, with caution regarding sustainability.

– Quality: Stocks with strong financial health, potentially delivering higher returns.

– Growth: Stocks with higher revenue or earnings growth potential compared to peers.

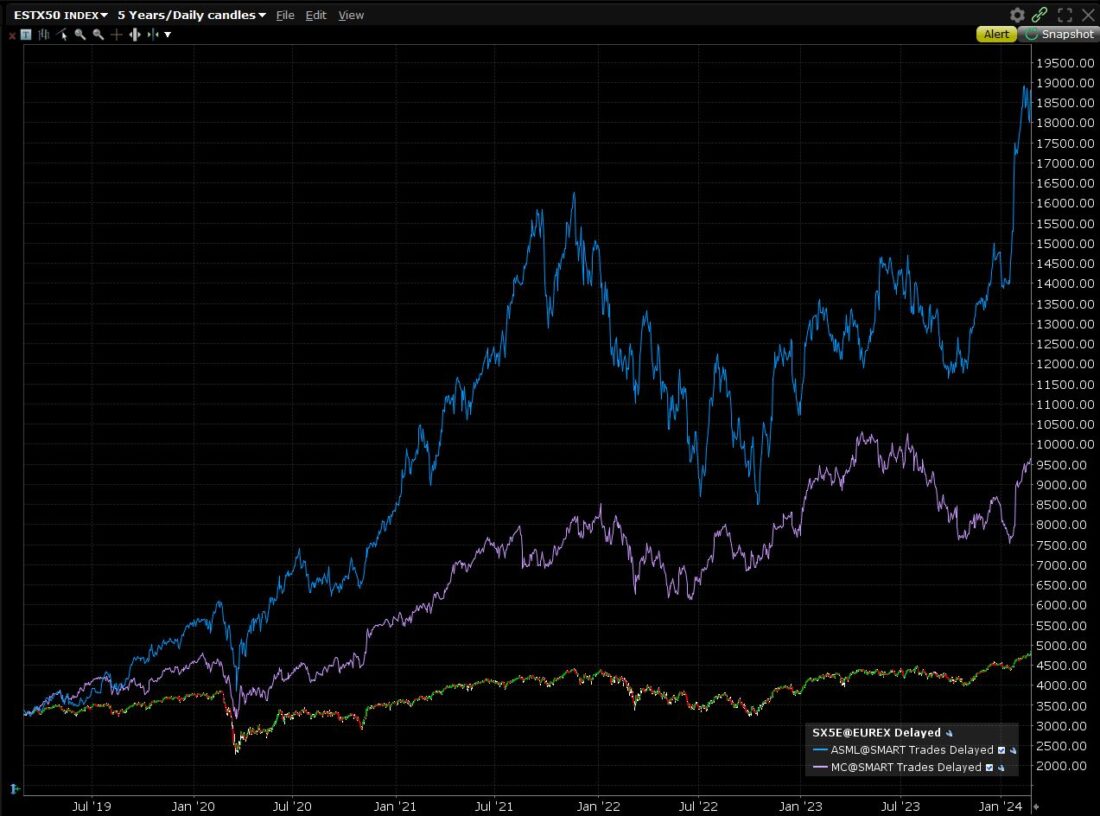

For instance, LVMH (MC) and ASML Holding (ASML) exhibit similarities in risk/returns despite being from different sectors and countries, owing to factors like large market capitalization, growth, and quality.

Source: ibkr.ie TWS Past performance is not indicative of future results.

Factors are quantifiable characteristics. A quality factor portfolio might include companies with ROE, ROA, operating margin, and debt metrics meeting specific criteria. Similarly, a value factor portfolio might focus on companies with low P/E and P/B ratios.

Factor investing serves to pursue outperformance or manage risk within portfolios. We can explore ways to adjust our portfolios based on market expectations or assess the diversification level within our portfolio.

Adapting to market expectations

For instance, in periods of low interest rates where the expectation is for rates to remain low, overweighting growth stocks could be a strategic choice due to their historical outperformance. Several factors contribute to this trend:

- With low interest rates, investors may struggle to attain target returns through bonds or blue-chip investments, prompting them to seek higher-risk assets.

- Low-interest environments enable companies to access favourable financing, encouraging investments in growth-oriented and riskier projects.

This explains the recent outperformance of growth stocks against traditional benchmarks during periods of low interest rates.

Quality stocks may exhibit better performance during economic downturns due to their stronger fundamentals, making them more resilient.

Diversification

Two value stocks are likely to exhibit higher correlations with each other compared to their correlations with other factors like growth, owing to their similarities.

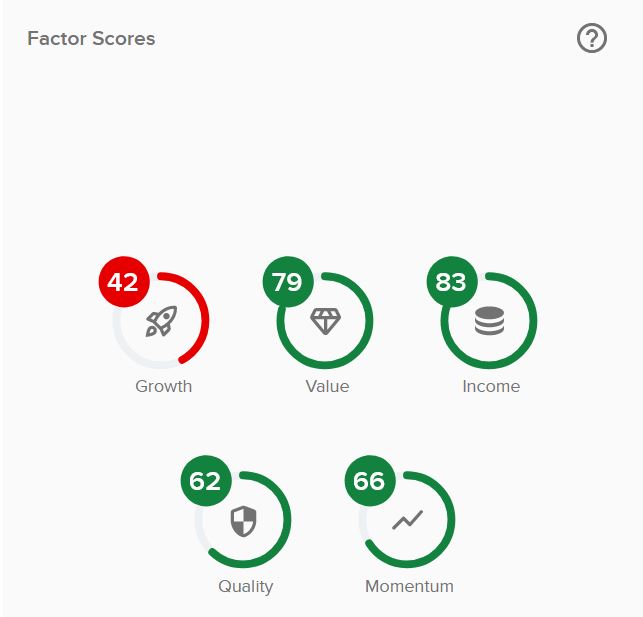

Factors are not mutually exclusive. For example, here are the Factor Scores for Bayerische Motoren Werke AG (BMW) at present:

Source: ibkr.ie Trading Central

Some European stocks examples for each factor:

Value: British American Tobacco (BATS), Novartis (NOVN) and Stellantis (STLAM).

Small cap: Kongsberg Gruppen (KOG), InterContinental Hotels Group (IHG) and Rheinmetall (RHM)

Momentum: Novo Nordisk (NOVO), Air liquid (AI) and TotalEnergies (TTE)

Minimum volatility: GlaxoSmithKline (GSK), BAE System (BA.) and Inditex (ITX)

Dividend yield: NN Group (NN), Endesa (ELE) and Orange (ORA)

Quality: ASML Holding (ASML), LVMH (MC) and Novo Nordisk (NOVO)

Growth: ASML Holding (ASML), LVMH (MC) and SAP (SAP)

Factors mentioned above can be viewed in the IBKR trading tools at: Trading Central or Market Scanner

Read more information about Factor Performance in Europe in 2023 here

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.