Study Notes:

Conditional orders allow the user to create multiple stipulations for multiple instruments that must be true to activate an order. For example, you may want to buy 100 shares of symbol AAPL at the market if SPY drops 3%. Conditional orders can be created in both TWS Classic and Mosaic and used outside of regular trading hours. A conditional order can also be used to cancel a prevailing order. For example, if you have a limit order to buy 100 shares in symbol AAPL, you could create a conditional order that would cancel that order in the event that symbol SPY is higher on the day by more than 2%.

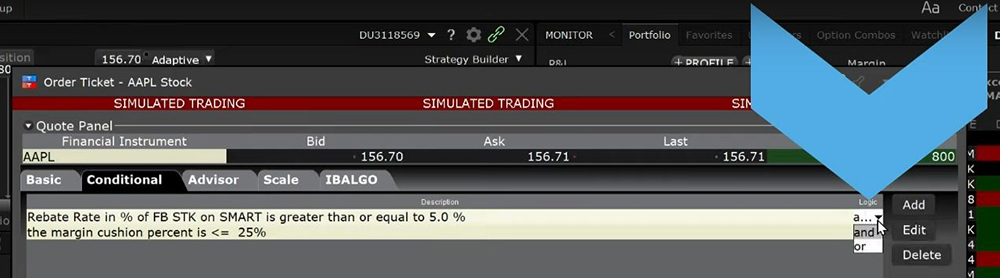

We will now walk through creating a conditional order in Mosaic to buy 500 shares of AAPL at the market if the rebate rate in Meta – symbol FB – becomes greater than or equal to 5%, or the margin cushion is 25% or lower. And choose to allow the conditions to be satisfied outside of regular trading hours. Later, we will then edit the existing order to change the margin cushion from 25% to 20%.

- From the portfolio tab or any Watchlist right click on the symbol AAPL and scroll down to “Trade”.

- From here select either: “Create a Buy Ticket” or “Order Ticket”.

- Once selected an order ticket box will appear displaying the Basic tab .

- Even if you choose “Create a Sell Ticket” accidently, it can be changed in the upper left-hand side under “Action”.

- We’ll create a market order for 500 shares. Once you have input all the order criteria click on the Conditional tab to the right.

- If you don’t see it there click on the grey arrow to the right of the last tab.

- At the bottom of the screen click on the box next to “Allow condition to be satisfied and activate outside of regular trading hours” and choose to submit an order if the stipulations are triggered. Underneath is where you can select to cancel the order instead.

- Now we will create the conditions necessary for the order to be submitted. Click on the Add button in the top right-hand corner and the “Create Condition” box appears.

- You can choose from the following conditions: Price, Margin Cushion, Volume, Percentage Change, Rebate Rate in Percent, Time, Daily P&L, Trade, and Shortable Shares.

- We will start with setting a condition for the rebate rate in percent. Click Next.

- Now select another underlying, it does not need to be the same underlying the order is for. I’ll choose FB for Meta, and set the rate to greater or equal to 5%. Click Finish.

I will add a second condition by clicking on the Add button, choosing Margin Cushion, and next. I’ll choose less than or equal to 25%. On the far right of each condition is the word “and”. You can choose whether multiple conditions need to be met, some conditions need to be met, or just one of the conditions needs to be met by switching between “and” and “or”. For this order set the conditions so either one will trigger the order by changing and to or.

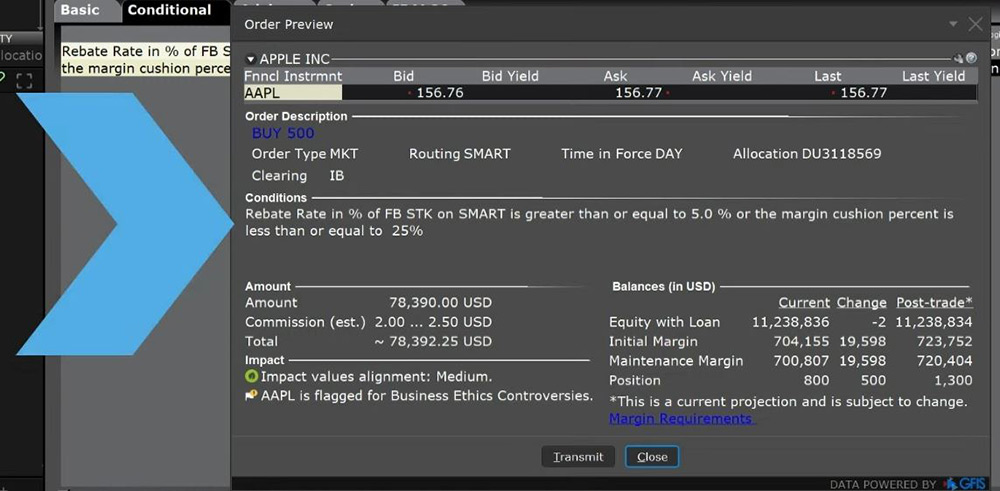

When everything is set click Preview on the bottom left-hand corner and the Order Preview box will appear. In the middle the Conditions section displays a summary of the condition or conditions needed for the order to be submitted. When ready click Transmit in the lower left-hand side. The order will populate the Activity panel with a green background for the row indicating it is a Conditional Order.

Once the order is sent and has not been activated you can go in and change the conditions and/or order details by right clicking on the row and selecting Modify, then either Order ticket or Condition. Selecting Condition will take you directly to the Conditional tab while if you select Order Ticket you will have to click on the tab when the Order ticket appears on the screen. Once you are in the Conditional tab click on one of the Conditions. Let us choose margin cushion. Click on Edit on the right-hand side. We will change the Condition parameters to 20%. Click Finish. Click Transmit.

Conditional Orders allow the user to create an order dependent on a single or multiple defined stipulations to trigger it. They can be extremely useful in preventing an order from being sent unless certain circumstances become true.