Study Notes:

The US Treasury market is perhaps the most liquid market in the world on account of its size and demand for the safety of debt issued by the government of the world’s largest economy. IBKR clients can add predefined watchlists to their Trader Workstation or TWS and can add specific securities to their Monitor panels to view quotes for securities that they care about.

Defining US Treasuries Bills, Notes, & Bonds

Let’s first add some definition to maturities. When the government issues debt securities, they generally always have a maturity date. The maturity length determines whether the debt is known as a bill, note or bond. Bills generally have a maturity of less than one-year. Bills are generally issued at a discount and carry no coupon. Because they are issued at a discount to par, they imply a rate of interest, which the holder receives at maturity. Notes have maturities or greater than one-year, but less than 10-years. Bonds have maturity dates longer than 10-years. This is important when using filters on government debt.

The US Treasury issues short-term and long-term debt via Primary Dealers and to the investing public via Treasury Direct.

Displaying a US Treasury contract in TraderWorkstation

There are several ways to display a specific US Treasury security.

If the investor knows the ISIN – the Treasuries’ unique identifier, they can add that to a cell in the TWS Watchlist or directly into the TWS Order Entry panel.

However, it’s more likely that the investor will want to filter by a specific maturity date to locate a certain bill, note or bond.

Searching for a US Treasury contract in Trader Workstation

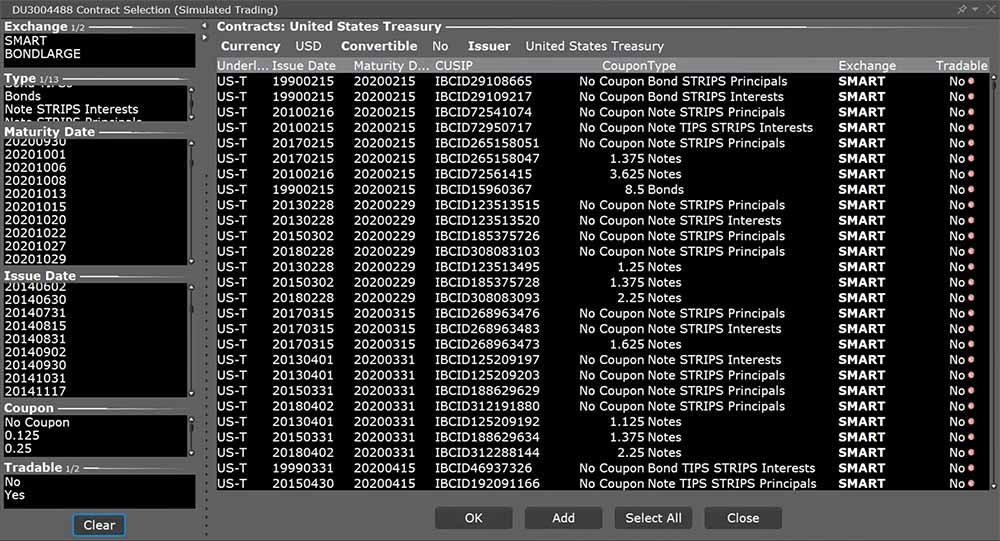

IBKR clients can access quotes and may trade bills, notes and bonds using TWS by entering the term ‘US-T’ then clicking on Government Bonds under US Treasury. A Contract Selection page will display. The aim here is to narrow down the search to the most useful information.

Under the Exchange display in the upper left corner, select SMART. In the lower left corner, eliminate non-tradable bonds by selecting “Yes” from the Tradable selection box.

There are four additional filters in the left-hand column that will help narrow down a search.

- Type: the investor can select Bills, Notes, or Bonds.

- Maturity Date

- Issue Date

- Coupon Rate

Clicking the “Clear” button at the bottom of the screen will reset all the filter choices.

If the investor wants to monitor multiple securities expiring within a broad date range, these can be selected from the Contract Selection tool. For example, a note investor might want to add several 10-year notes with the farthest possible maturity dates. Having located them by selecting SMART, Notes and selecting Tradable from the left columns, the user may scroll down to the bottom of the Contract Selection array of results, and use the CTRL and SHIFT keyboard keys to highlight the desired selection. Click Add to add to the active Watchlist and OK to close the Contract Selection tool.

The Watchlist now displays the selected notes. Users may wish to Configure their Watchlist to include Bond specific items, such as bid yield, ask yield etc. by clicking on the gear icon in the top right-hand corner of the Watchlist and choosing “Settings”.

Buying a US Treasury contract in TWS

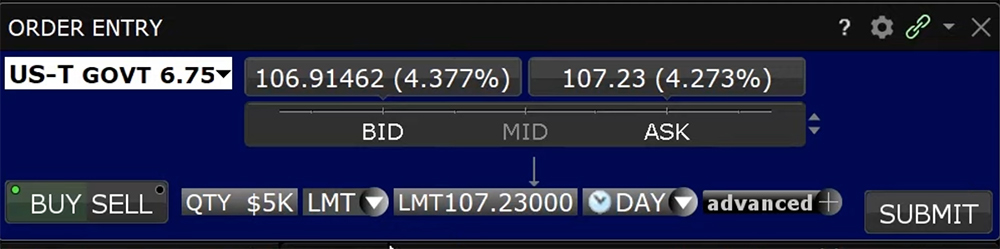

Click on a specific bond to add it to the Order Entry panel.

Click the Buy button.

By default, TWS displays the minimum quantity that could be purchased. Change the Quantity field to your desired amount. Bonds are typically issued with $1,000 par or face value.

From the Order Type dropdown menu choose between Limit and Market order types. Because certain exchanges to which treasury orders may be routed do not accept market orders, we always recommend specifying a Limit price and entering a maximum price that you are prepared to pay for the bond.

When the investor is satisfied with their order, they click Submit in the lower right corner. An order confirmation screen will appear, once reviewed the investor can click Transmit. The live order will appear in the Activity panel below on the Orders tab, where the user may adjust the price and quantity or cancel the order altogether.

Selling a US Treasury contract in TWS

Long positions can be sold in a similar manner. From the Portfolio tab click on the bond, which will cause it to populate the Order Entry panel. The user clicks the Sell button and enters a Limit price before clicking the Submit button.

Short Selling US Treasuries in TWS

To create a short position in a US Treasury security, identify the bill, note or bond to sell short such that it also populates the Order Entry panel. For short sales, there is an additional volume qualifier. In order to enter a short position, the user must specify a quantity minimum of $250,000 and incremental volume of a further $250,000. That means that short sales would be for at least 250 bonds, with additional increments of 250 bonds.

From the Order Entry panel with the bond loaded, the user clicks the Sell button, specifies a quantity to satisfy order minimum and incremental size, and enters a limit price before clicking Submit.

Additional Information:

Users may also enter orders for TIPS and Strips for bills, notes and bonds for both interest and for principal amounts.

IBKR Bond Scanner – Users can scan for US Treasuries by type, maturity date range and additional category from the IBKR Bond Scanner. To access from the New Window button to the upper left of TWS, from the Scanners expansion menu select Bond Scanner.

Predefined Watchlists – Users may also add key US Treasury yield data to a watchlist using on-the-run treasury prices. In the Monitor panel, locate and click the ‘+’ icon to the right of the open watchlists.

Select Predefined Watchlists. Locate and select US Treasuries (on-the-run) to add this to your available Watchlists.

Configuration: To add column data to a Watchlist, hover above the column-header, right-click and select Manage Columns. From the right column in the display menu search for desired terms and add them to the Displayed Column from the Available section.